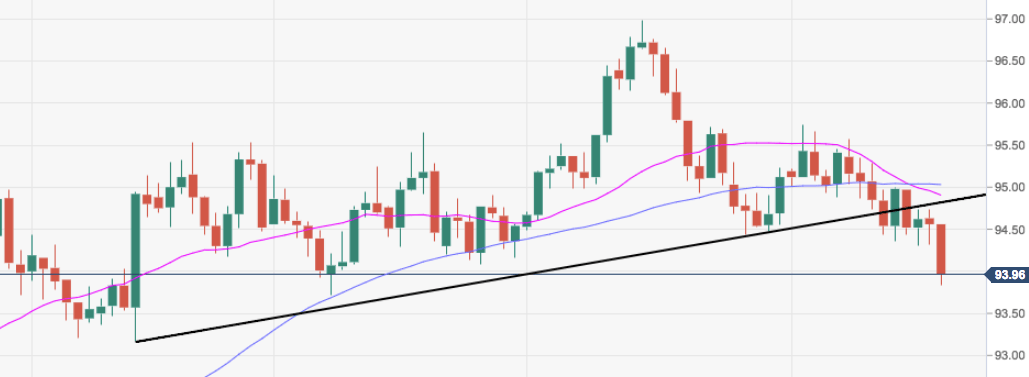

- The greenback is entrenched into the negative ground for yet another session and has prompted DXY to break below the key 94.00 support for the first time since mid-July.

- The sharp pullback in the buck came amidst an intensification of the better sentiment in the risk-associated complex pari passu with the deterioration of the outlook for USD despite prospects of further tightening by the Fed and rising US yields.

- That said, a deeper retracement should see July’s low at 93.71 re-tested ahead of June’s low at 93.19.

DXY daily chart

Daily high: 94.56

Daily low: 93.83

Support Levels

S1: 94.34

S2: 94.13

S3: 93.93

Resistance Levels

R1: 94.75

R2: 94.95

R3: 95.16