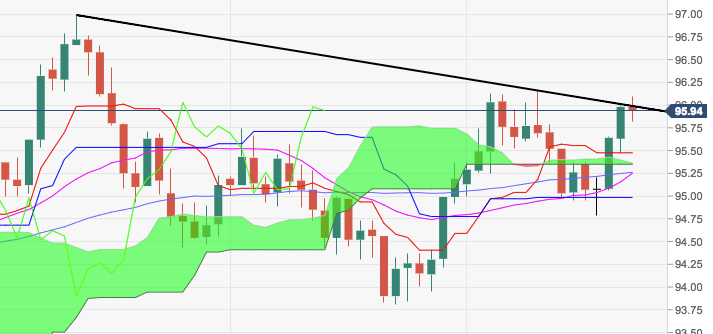

- DXY is gathering further traction at the end of the week and is now trading at either side of the 96.00 milestone, or fresh weekly peaks.

- Immediate target remains the lower 96.00s, where align tops seen earlier in the month. Reinforcing this resistance area lies a Fibo retracement of the 2017-2018 drop at 96.04

- The greenback is also eroding the short-term resistance line, today at 95.99, and a breakout of this area on a convincing fashion is needed to allow for extra gains and a potential visit to YTD highs in the 97.00 neighbourhood.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.95

Daily change: -3.0 pips

Daily change: -0.0313%

Daily Open: 95.98

Trends:

Daily SMA20: 95.22

Daily SMA50: 95.24

Daily SMA100: 94.91

Daily SMA200: 92.83

Levels:

Daily High: 96

Daily Low: 95.48

Weekly High: 96.16

Weekly Low: 94.95

Monthly High: 95.74

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.8

Daily Fibonacci 61.8%: 95.68

Daily Pivot Point S1: 95.64

Daily Pivot Point S2: 95.3

Daily Pivot Point S3: 95.12

Daily Pivot Point R1: 96.16

Daily Pivot Point R2: 96.34

Daily Pivot Point R3: 96.68