- The index remains on the defensive so far this week, coming under pressure following a pick up in the sentiment surrounding the riskier assets.

- After the recent drop from YTD peaks above 97.00 the figure, the greenback appears in a consolidative theme albeit always above the 96.00 milestone for the time being.

- On the downside, strong contention emerges in the 96.00 neighbourhood, where converge recent lows and a Fibo retracement of the 2017-2018 drop.

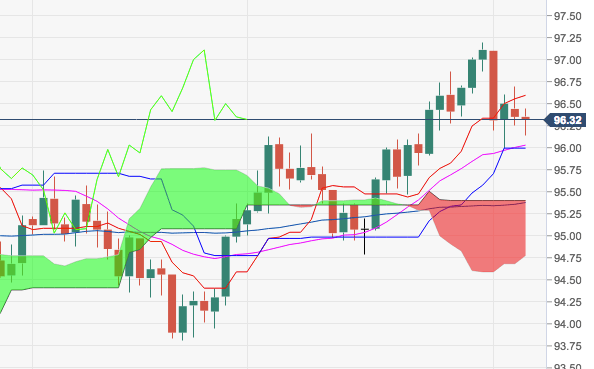

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.28

Daily change: -7.0 pips

Daily change: -0.0727%

Daily Open: 96.35

Trends:

Daily SMA20: 96.01

Daily SMA50: 95.38

Daily SMA100: 95.2

Daily SMA200: 93.21

Levels:

Daily High: 96.69

Daily Low: 96.25

Weekly High: 97.2

Weekly Low: 95.99

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.42

Daily Fibonacci 61.8%: 96.52

Daily Pivot Point S1: 96.17

Daily Pivot Point S2: 95.99

Daily Pivot Point S3: 95.73

Daily Pivot Point R1: 96.61

Daily Pivot Point R2: 96.87

Daily Pivot Point R3: 97.05