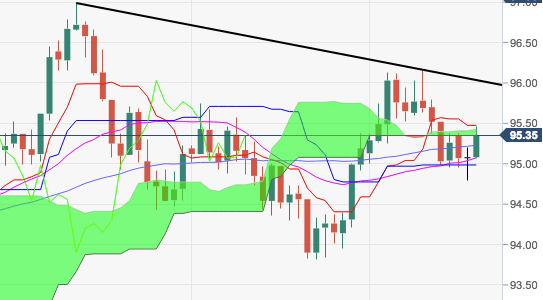

- The index is up for the second session in a row today and is now looking to extend the recent breakout of the critical barrier at 95.00 the figure.

- Key resistance remains the 95.40 region, where sit recent peaks and the 10-day SMA.

- Immediate target on the upside is the 95.40 region, where aligns recent tops and the base of the daily cloud. This area is considered the last defence ahead of a test of October’s tops beyond the 96.00 mark, where is also located a Fibo retracement of the 2017-2018 drop and the short-term resistance line.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.35

Daily change: 27 pips

Daily change: 0.284%

Daily Open: 95.08

Trends:

Daily SMA20: 95.06

Daily SMA50: 95.23

Daily SMA100: 94.88

Daily SMA200: 92.79

Levels:

Daily High: 95.2

Daily Low: 94.79

Weekly High: 96.16

Weekly Low: 94.95

Monthly High: 96.16

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.04

Daily Fibonacci 61.8%: 94.95

Daily Pivot Point S1: 94.85

Daily Pivot Point S2: 94.61

Daily Pivot Point S3: 94.44

Daily Pivot Point R1: 95.26

Daily Pivot Point R2: 95.43

Daily Pivot Point R3: 95.67