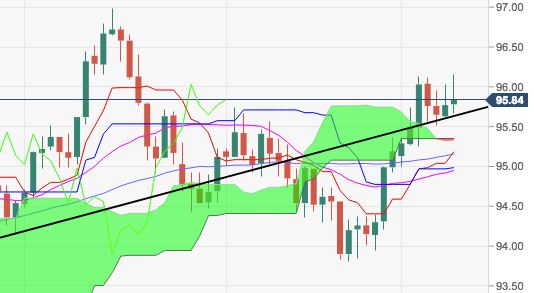

- DXY has once again tested the area above 96.00 the figure but lacked of follow through, prompting the ongoing retracement along with a similar performance in yields of the US 10-year note.

- The constructive outlook in the buck stays unchanged as long as the short-term support line underpins, today at 95.63.

- A close above recent peaks in the 96.10/15 band seems needed in order to attempt another visit of 2018 peaks just below 97.00 the figure (August 15).

- Collaborating with the positive view, DXY keeps trading above the daily cloud.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 95.82

Daily change: 5.0 pips

Daily change: 0.0522%

Daily Open: 95.77

Trends:

Daily SMA20: 94.91

Daily SMA50: 95.2

Daily SMA100: 94.81

Daily SMA200: 92.7

Levels:

Daily High: 96.03

Daily Low: 95.6

Weekly High: 96.13

Weekly Low: 95

Monthly High: 96.13

Monthly Low: 93.81

Daily Fibonacci 38.2%: 95.87

Daily Fibonacci 61.8%: 95.76

Daily Pivot Point S1: 95.57

Daily Pivot Point S2: 95.37

Daily Pivot Point S3: 95.14

Daily Pivot Point R1: 96

Daily Pivot Point R2: 96.23

Daily Pivot Point R3: 96.43