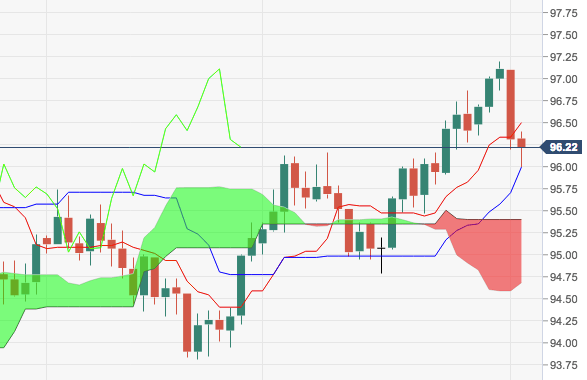

- The greenback has extended the sharp sell of to the 96.00 neighbourhood today, where lies a Fibo retracement of the 2017-2018 drop.

- The breakdown of this area of contention should open the door for a probable visit to the 21-day SMA at 95.94 ahead of the mid-95.00s.

- All in all, as long as July’s low at 93.71 underpins, the constructive bias in the greenback is expected to persist.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 96.22

Daily change: -9.0 pips

Daily change: -0.0934%

Daily Open: 96.31

Trends:

Daily SMA20: 95.94

Daily SMA50: 95.32

Daily SMA100: 95.17

Daily SMA200: 93.14

Levels:

Daily High: 97.1

Daily Low: 96.2

Weekly High: 96.86

Weekly Low: 95.47

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.54

Daily Fibonacci 61.8%: 96.76

Daily Pivot Point S1: 95.97

Daily Pivot Point S2: 95.64

Daily Pivot Point S3: 95.07

Daily Pivot Point R1: 96.87

Daily Pivot Point R2: 97.44

Daily Pivot Point R3: 97.77