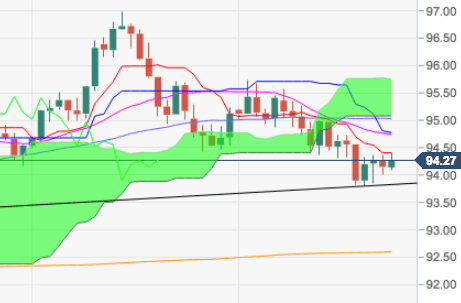

- DXY is extending the sideline theme for yet another session, managing well to stay above the 94.00 handle although with gains still capped around the 94.40 region, where converges the key 10-day SMA.

- Support remains well in place around the 93.80 zone, although a disappointment at today’s FOMC meeting carries the potential to drag the buck to, initially, 93.71 ahead of 93.19.

- In case the selling impetus gathers traction, the critical 200-day SMA at 92.59 should emerge on the horizon.

- On the upside, the key barrier stays unchanged at the 95.00 neighbourhood for the time being.

DXY daily chart

Daily high: 94.40

Daily low: 94.08

Support Levels

S1: 93.94

S2: 93.63

S3: 93.32

Resistance Levels

R1: 93.98

R2: 93.82

R3: 94.70