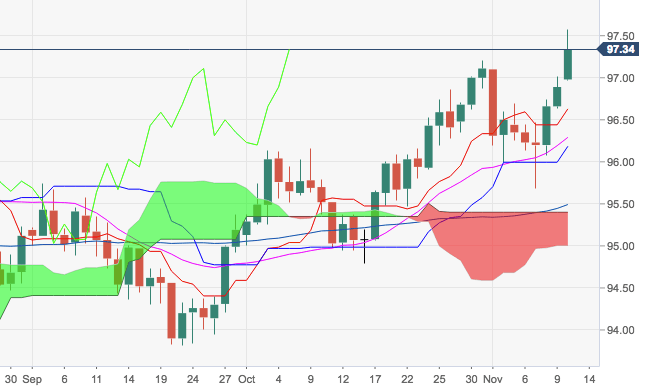

- The upbeat momentum around the greenback remain unabated for yet another session and is now pushing DXY to the 97.60 region, or fresh YTD peaks.

- The continuation of the bull run should meet the next resistance of note at 97.87, where coincide a Fibo retracement of the 2017-2018 drop and June’s 2017 top.

- In addition, the constructive stance in the greenback should remain unchanged as long as July’s low at 93.71 holds.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 97.32

Daily change: 43 pips

Daily change: 0.444%

Daily Open: 96.89

Trends:

Daily SMA20: 96.24

Daily SMA50: 95.51

Daily SMA100: 95.26

Daily SMA200: 93.36

Levels:

Daily High: 97.01

Daily Low: 96.63

Weekly High: 97.01

Weekly Low: 95.68

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 96.86

Daily Fibonacci 61.8%: 96.78

Daily Pivot Point S1: 96.68

Daily Pivot Point S2: 96.46

Daily Pivot Point S3: 96.3

Daily Pivot Point R1: 97.06

Daily Pivot Point R2: 97.22

Daily Pivot Point R3: 97.44