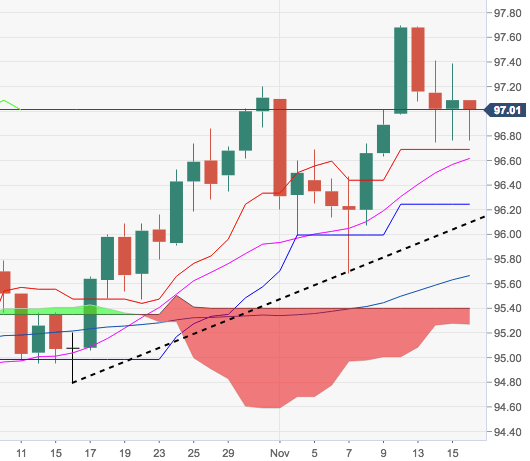

- The index is prolonging the choppy trade so far this week and continues to navigate the 97.00 neighbourhood with moderate support in the 96.80 area, where converges the 10-day SMA.

- In case the selling impetus picks up pace, the 21-day SMA at 96.60 should offer interim contention ahead of the more relevant 95.68, monthly lows so far.

- Furthermore, the constructive bias is poised to persists as long as the short-term support line at 96.09 holds.

DXY daily chart

Dollar Index Spot

Overview:

Last Price: 97

Daily change: -9.0 pips

Daily change: -0.0927%

Daily Open: 97.09

Trends:

Daily SMA20: 96.6

Daily SMA50: 95.68

Daily SMA100: 95.36

Daily SMA200: 93.5

Levels:

Daily High: 97.39

Daily Low: 96.76

Weekly High: 97.01

Weekly Low: 95.68

Monthly High: 97.2

Monthly Low: 94.79

Daily Fibonacci 38.2%: 97.15

Daily Fibonacci 61.8%: 97

Daily Pivot Point S1: 96.77

Daily Pivot Point S2: 96.45

Daily Pivot Point S3: 96.14

Daily Pivot Point R1: 97.4

Daily Pivot Point R2: 97.71

Daily Pivot Point R3: 98.03