- US Dollar Index faces downside pressure after FOMC.

- Missed figures for PCE also weigh on the DXY.

- US NFP data can provide fresh impetus to the market.

The weekly analysis of the DXY Dollar Index shows a mildly bearish bias, but with a strong hope of recovery. The technical side is bulls oriented. The US Dollar fell as a result of the US Federal Reserve’s interest rate decision last week. Fed Chairman Jerome Powell revealed significant restrictive remarks, noting that long-term inflation expectations and indicators align with the central bank’s long-term target of 2%. The market has learned this language easily because stocks and other risky assets can fall to the US dollar’s detriment.

–Are you interested to learn more about buying cryptocurrencies? Check our detailed guide-

Some saw the steep rally as a possible sign that the Fed is or will be taking a more restrictive approach, perhaps setting a timetable or discussing a balanced cut. Inflation indicators and short-term expectations have risen since the economic recovery. As a result, the DXY dollar index reached a new high several months before the July interest rate decision.

The DXY Dollar Index remained lower in the week after PCE data went out of bounds for June on Friday. The PPE core index, which does not include volatile food and energy prices, exceeds the 3.5% mark and fell to 3.7%, rising from 3.4% in May. While this precludes a brief report, for the time being, prices remain well above the 2% target. The next FOMC meeting will not be held until the end of September.

This is likely to largely leave the calculation of political expectations unchanged and make negotiators wait for other important events in the future. However, the July non-farm payroll on Friday is the next potentially eventful financial report. Analysts expect this number to exceed 925k, up from 850k in June. Stronger-than-expected pressure could trigger some US Dollar strength.

Key events to look out next week

The most important event ahead is the US NFP report due on Friday. The US employment report on Friday is critical for the US Dollar. The nonfarm labor market is expected to grow to 926,000 in July, reducing unemployment by two clicks to 5.7 percent. It seems like many people are now returning to the labor market after the generous unemployment benefits have expired.

The US economy needs about 6.7 million jobs to fully recover. However, many people have decided to retire after the pandemic broke out. Some estimates put it at around 3 million. As a result, America could need about 4 million jobs to fully recover, which means we could be at full employment by the end of the year.

DXY weekly technical analysis: Key levels to watch

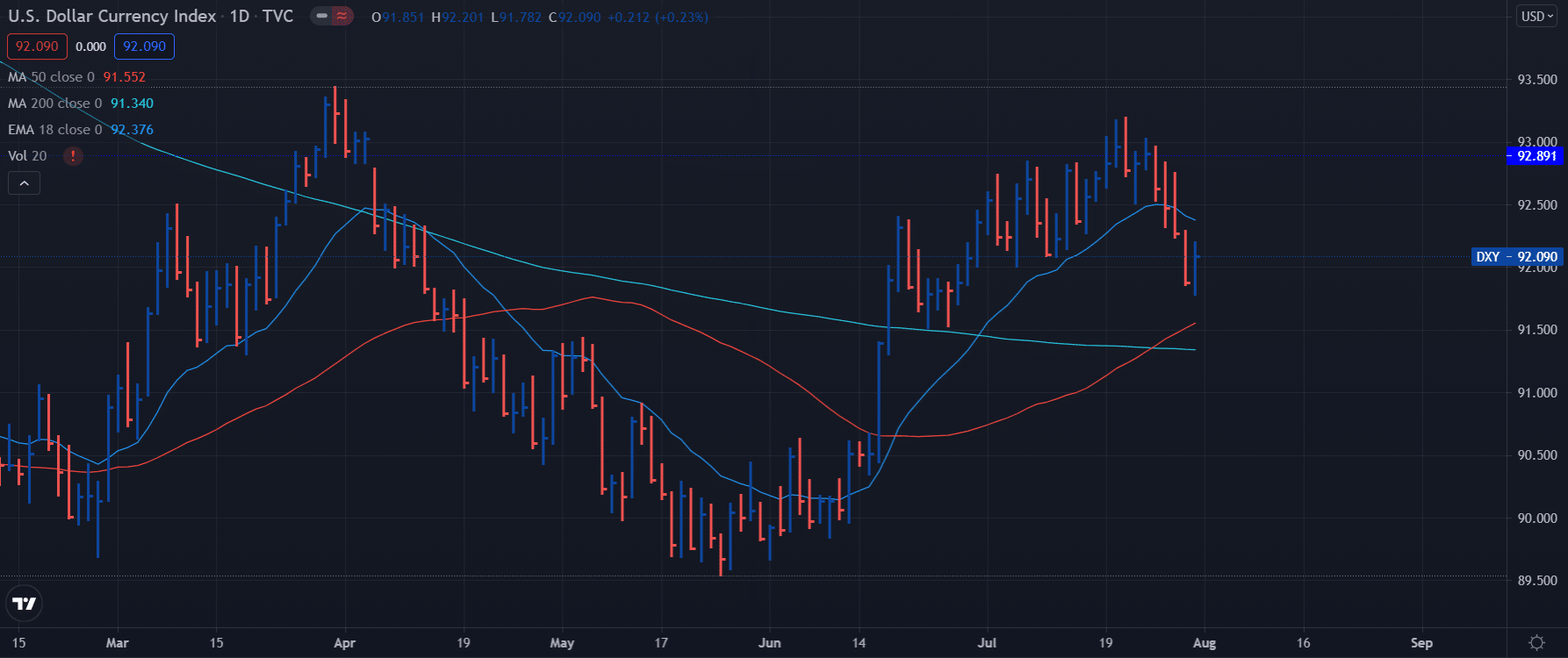

The DXY price found some bids around the weekly lows of 91.78 and managed to surge beyond the 92.00 handle on Friday. The bullish crossover of 200-day SMA and 50-day SMA points out for more gains. The upside move may find a hurdle at 20-day SMA near 92.40. The next resistance could be the swing high of July 21 at 93.20.

–Are you interested to learn more about forex robots? Check our detailed guide-

On the downside, 50-day SMA serves as immediate support at 91.55 followed by 200-day SMA at 91.30.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.