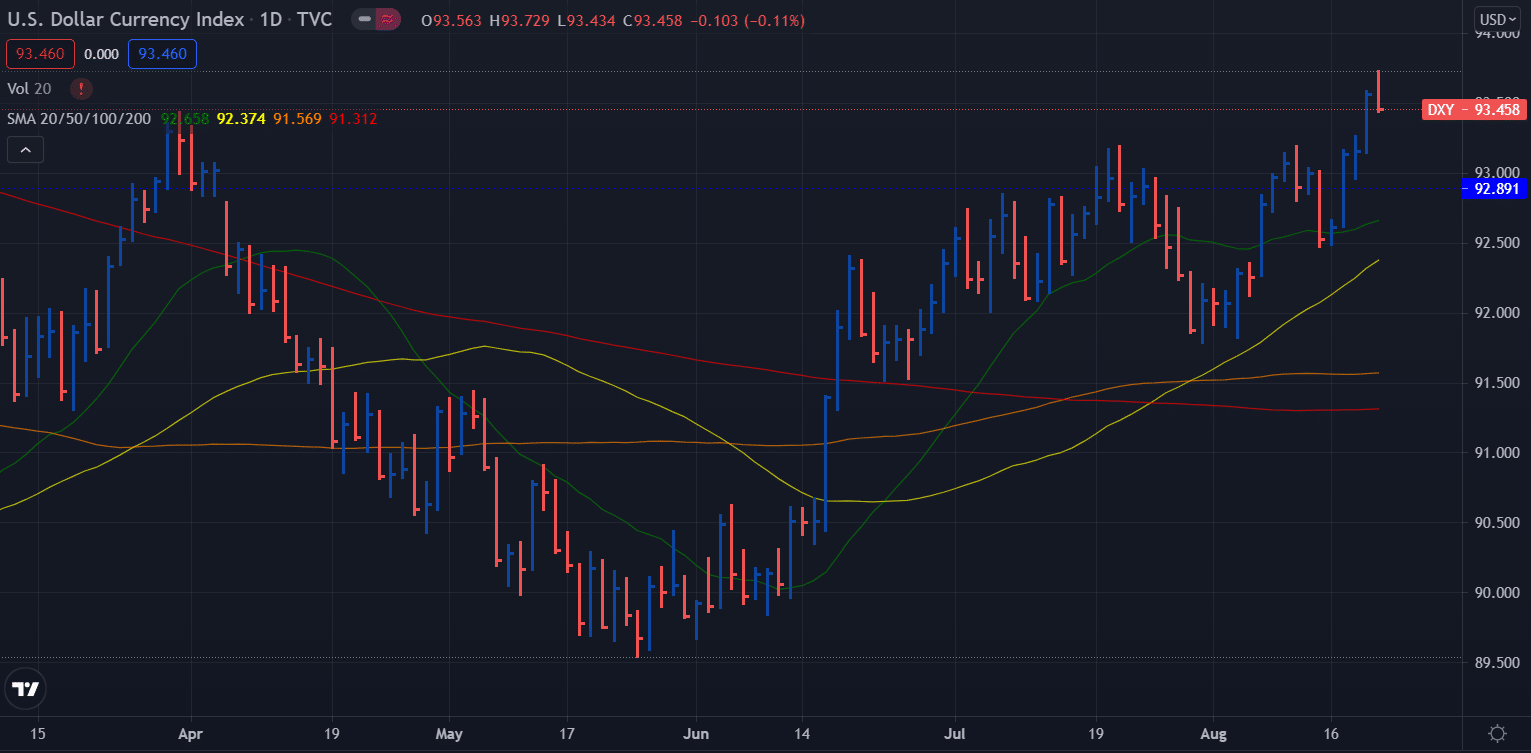

- DXY Dollar Index made yearly highs this week as risk sentiment remains sour.

- Fed’s tapering clues taken from July’s meeting minutes are lending big support to the US dollar.

- Jackson Hole Symposium is the key event next week, and Fed is expected to outline its tapering plan for the event.

- The core CPE price index is likely to gain, giving more room to the dollar bulls.

The weekly forecast for the DXY Dollar Index is bullish amid risk-off sentiment and potentially a clear decision of tapering to come out next week.

The DXY Dollar Index posted fresh yearly highs at 93.72 this week, starting the week from 92.51. The index closed the week with a net gain of 94 pips.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

The US dollar keeps leading the forex market. The two key variables contributing to the stronger Greenback are risk-off sentiment stemming from the spread of Delta variant worldwide and the Taliban’s capture of Afghanistan, followed by FOMC’s reiteration to taper the asset purchase program.

Is Jackson Hole really worth all the hype?

The Federal Reserve has long been touted by investors as the perfect excuse to announce strangulation of the economy. In the past, the Kansas City Fed’s annual economic symposium has often served to highlight major policy developments.

There are growing concerns about how markets will be treated at the August 26-28 event, as Fed officials have been swaying left, right, and center lately. For example, policymakers appeared divided over the exact timing and pace of the cut in asset purchases in the July FOMC minutes, even though they agreed on the cap needed to start soon.

Are dollar bulls likely to see a gradual rise from the Fed?

The dollar would probably have reacted differently if Powell’s remarks had not enhanced traders’ wisdom, regardless of how traders responded to Powell. Earlier this year, the dollar index rose to a new high, and further gains could be expected if sentiment continues to deteriorate. Leaving markets in the dark about the Fed’s quantitative easing exit strategy may increase risk aversion, but will it necessarily boost the dollar?

Another danger Powell poses is that he signals a strong movement toward constriction, but he does not accompany it with sufficient confidence that it will be gradual. This can further stir panic in the face of new viral infections.

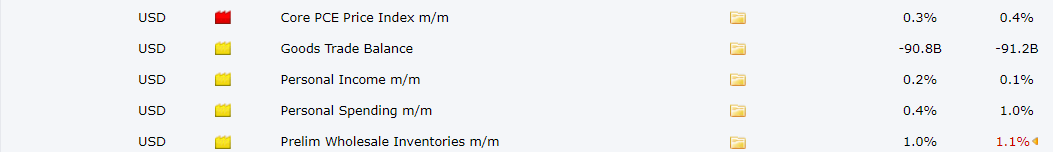

However, US data may offer some good news, which might allay concerns that the economy is slowing. According to the personal income and spending data released on Friday, income and consumption rose 0.2%, increasing 0.5% from June. In conjunction with these data, the PCE for the same month is published. Inflation is likely to rise from 3.5% at the beginning of the month to 3.6% on an annualized basis, indicating that price pressures are eased.

Could the underlying PCE price index support dollar bulls?

According to the PPI data, the core PCE price index could increase faster than the core consumer price index in July (0.4% versus 0.3%). Consumer spending likely rose less than prices; real costs are estimated to rise by -0.3% while nominal costs increase by 0.2%. An increase in child tax credit probably contributed to the increase in income (forecast: +0.6%).

–Are you interested to learn more about forex signals? Check our detailed guide-

Key data releases in the US during Aug 23-27

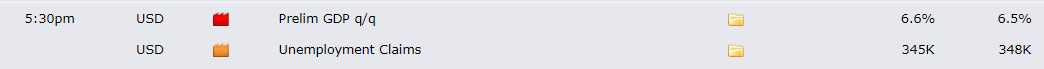

- Prelim GDP q/q: GDP is a primary gauge for economic health. The number is expected to slightly rise to 6.6% against the previous quarter’s reading at 6.5%. Upbeat figures will strengthen the odds of tapering/rate hikes.

- Unemployment claims: The weekly unemployment claims are likely to decrease to 345k against the previous week’s reading at 348k.

- Core PCE price index m/m: This is one of the most observed indicators to gauge the inflation and economic health of the US. The previous reading was quite dismal that had sent the dollar down. Coming reading for July is expected to slide further to 0.3%. However, any surprise (upbeat figures) can provide further support to the rising Greenback.

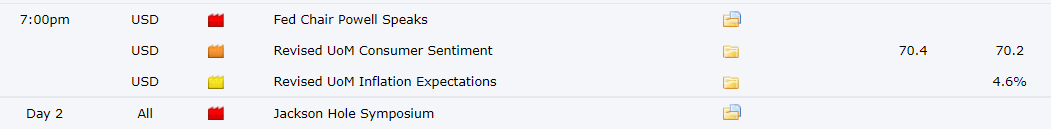

- Fed Chair Powell speaks: Investors will look for further clues about tapering and rate hikes on Friday.

- Jackson Hole Symposium (Aug 26-28): The three-day event is the most important release next week. Fed is likely to outline the plan for tapering in the symposium.

DXY Dollar Index weekly technical forecast: Bulls to regain from 93.20

The DXY Dollar index closed near the daily lows on Friday, forming a widespread down bar called a hidden upthrust. This indicates a downside correction that can be seen next week. However, the price can find support at the broken double top of 93.20.

The price is well bid above the key SMAs on the daily chart. Moreover, the 20, 50, 100 and 200 DMAs are lying one above another, a bullish sign.

On the upside, immediate resistance lies at the yearly tops around 93.70 ahead of 94.00, a psychological mark.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.