Let’s see how this affects indices. My bet is that it will make them a bit choppy, but push them to upside. The bottom line is that all US indexes closed last week at new all-time highs.

The new historical record in Russel shows how broad and deep the positive sentiment on US markets is.

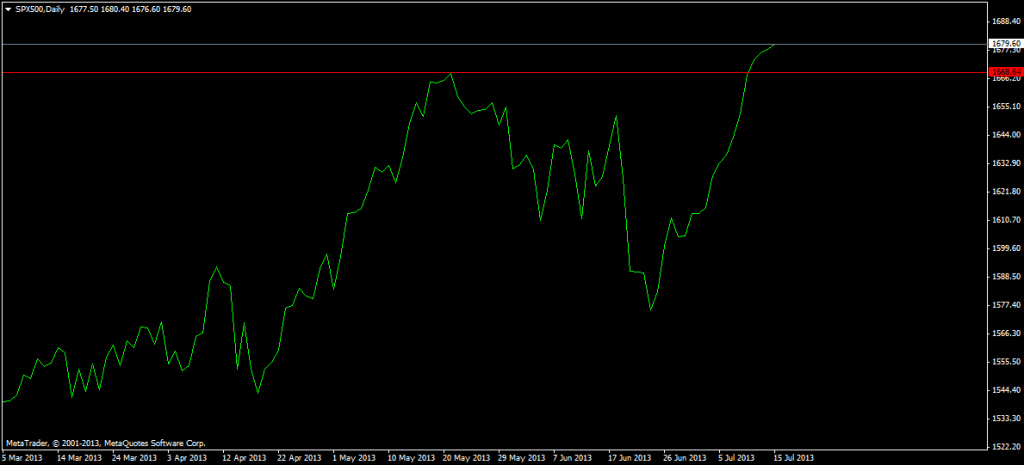

Technically the S&P500 made last week a breakout at 1670 and stayed steadily above this level, so we might see a couple of days of consolidation, and then try to test the 1670 level. But generally, the bulls are ruling the market. And, what we should do in the bull market – BUY IT AND DON’T SELL IT.

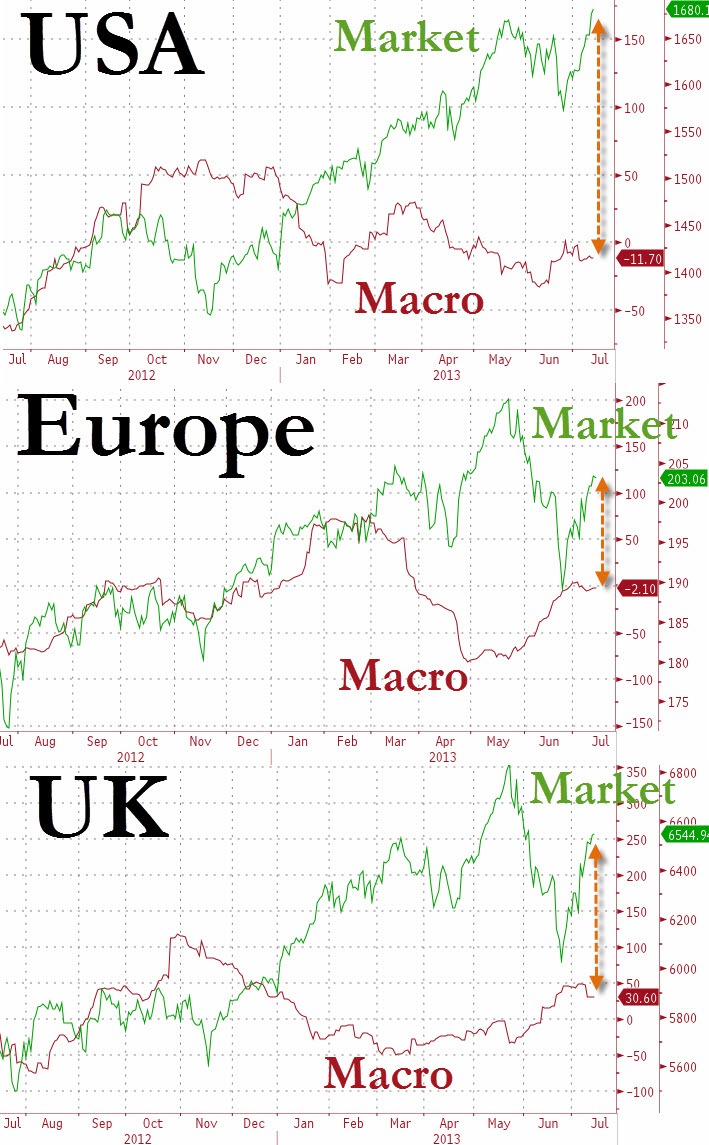

My only concern is the macro effect. I know we have seen this pattern continuously in the last four years a couple of times, but it makes sense how big the gap between the reality and market performance is. My question to you: if everything is great why does Bernanke need to save the US each month?

Basically the US economy is the second worst performing macro-economy of the year between the majors. This chart shows obviously the fact on macros, (chart by Zerohedge)