The euro has been trading in a downward trajectory on a variety of reasons. What’s next? The team at Credit Agricole remains bearish:

Here is their view, courtesy of eFXnews:

In April, the ECB will cut the pace of its monthly purchases from EUR80bn to EUR60bn.

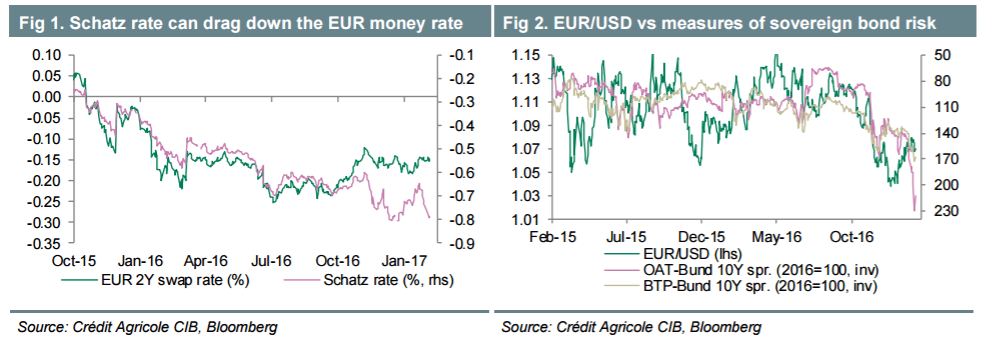

This, coupled with growing purchases of shortdated bonds, trading below the deposit rate floor, should compound the risks for EUR ahead of the election season in the Eurozone.

A slower pace of asset purchases will coincide with a period of more subdued private demand for EGBs ahead of the Dutch, French and German (and, potentially, Italian) elections. This could lead to further widening in peripheral spreads. In addition, growing purchases of the ‘under-owned’ short-end of the Bund yield curve should push shortterm European rates lower still.

The combination of reduced bond purchases and reallocation of some of these purchases towards the short-end of the curve will have a negative impact on EUR. Indeed, the ECB will be reducing purchases at a time when political risks in the Eurozone are growing ahead of the European elections. The changing balance between supply and demand could push bond yields higher still, leading to further widening of spreads to Bund yields. The drift higher could be further underscored by the changing longer-term outlook for ECB QE with the bank likely to preserve rather than boost the size of its monetary stimulus from here.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.

Historically, EUR was negatively correlated with widening spreads between BTP or OAT to Bund yields, and it is yet to respond to the latest pick up in sovereign debt risk. Further widening of those spreads could come on the back of more indications of growing popular support for the anti-establishment vote. In addition, a surprisingly strong showing of the anti-EUR PVV party at the Dutch general election on 15 March, could further fuel concerns about a growing wave of populism in Europe. In addition, more uncertainty about the next bailout tranche for Greece could further act as a catalyst for investors’ concerns about the outlook for EUR.

We remain bearish on EUR and expect further underperformance against USD and JPY.

*Credit Agricole maintains a short EUR/USD from 1.0705 targeting 1.0300.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.