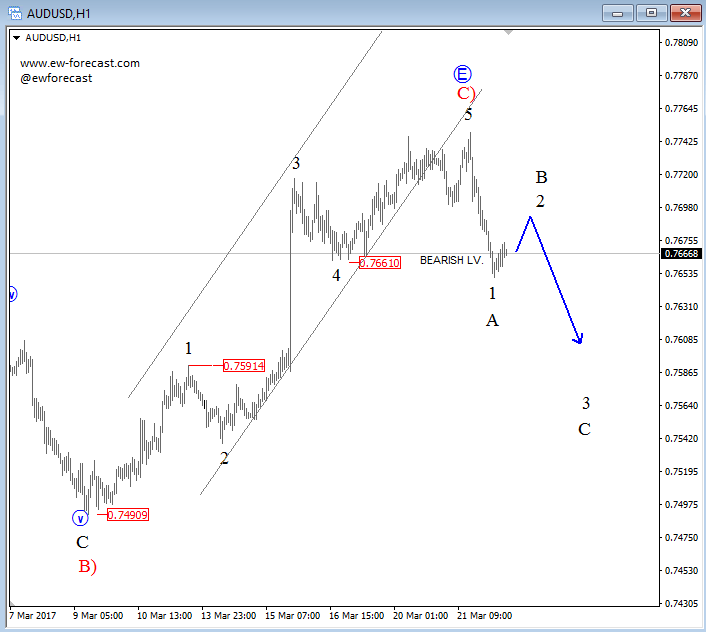

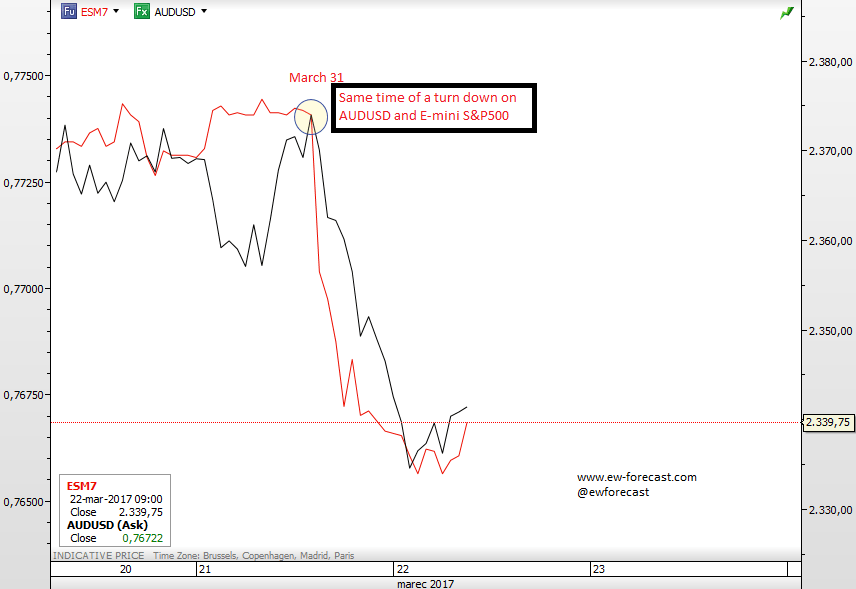

We can see that stocks are still under a strong bearish pressure so the Aussie may suffer as well. In fact, we see AUDUSD making a nice leg down from the highs, either its wave A or wave 1, but in both cases it means that the pair should see even lower levels within a three wave decline, after a bounce up in wave 2/B.

AUDUSD, 1H

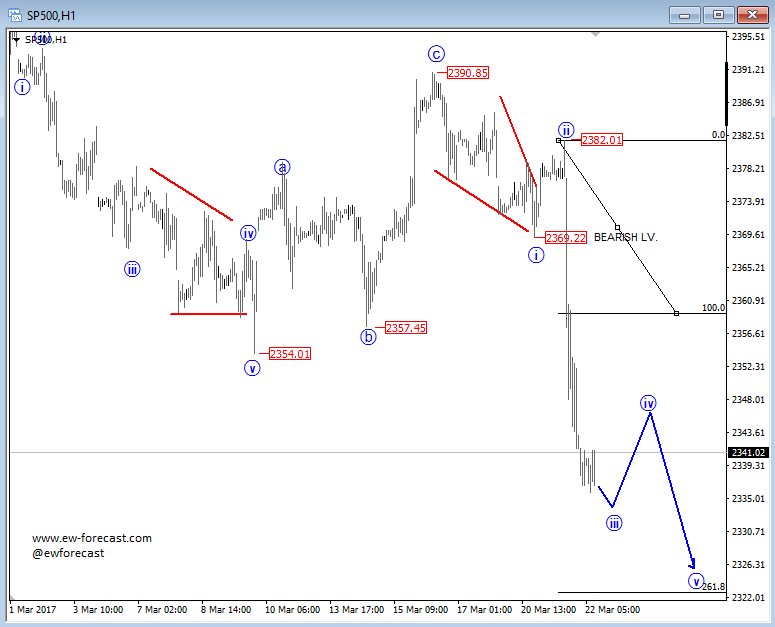

Stocks are also in a nice intraday downtrend, which is expected to continue through the next few sessions, as we need five waves down from 2390 before the market may turn higher again. So for now, let’s stick with the falling prices, meaning that the next short-term bounce will be limited, likely wave four of an ongoing decline that can extend down to 2320 area.

S&P500, 1H

S&P500 vs AUDUSD, 1H