USDCHF has made a big pullback since the end of 2015, regarded as a corrective and temporary decline. Notice that the falling price action is overlapping which is evidence of a contra-trend movement so we suspect that the downtrend is limited, especially after we identified an ending diagonal in wave C-circled. The final leg of a big wave IV is showing evidence of a low in place, following a recent bounce from 0.9440 area. Ideally, the market is now at first wave up of a new bullish cycle; three wave structure for wave V that will be looking for a move back to the highs.

USDCHF, Daily

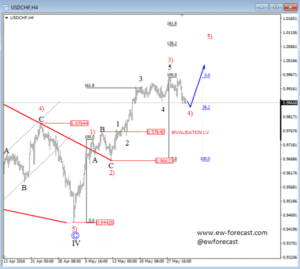

On the lower time frames, strong reversal on USDCHF since start of May from 0.9442 is very sharp and fast without any important overlaps, so we see the market making an impulsive run. Impulses are five wave patterns which move in the direction of a bigger trend, so we assume that the new bullish cycle is now unfolding based on the daily wave count, where we recognized an ending diagonal in wave C of IV at 0.9442 level. As such, we are looking up after any set-back on the 4h time-frame. At the moment, we see a minor corrective move down from the highs which appears to be red wave 4) that may find a support at area of a former wave four, near the current 0.9870 region.

USDCHF, 4H