EURUSD

Good morning traders. World markets are considerably up from lows during Asia trading hours. We will see if this rally will sustain. Brexit vote is this week on Thursday so be careful on increased volatility if you have any exposure. No major economic news today.

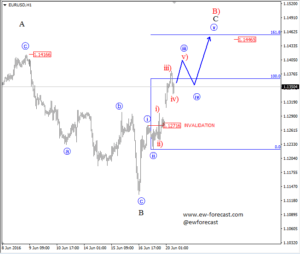

EURUSD reversed from the 1.12 area, that is why we are now tracking a temporary bullish count, but only in the corrective phase. We regard this move up as wave C and the current price is in the blue wave iii. The target for this C wave up is around 1.1460-70 region, where we can hit some resistance. Invalidation level is at 1.1271 – as long as this levels holds, count is valid.

EURUSD, 1H

AUDUSD

AUDUSD made the same reversal as the EUR but we think as in the case of the EURUSD, we are witnessing just a corrective pullback to the upside. So we will still stay bullish on USD from mid to long term. The current count on the Aussie is already close to completing black wave 3 with a pullback approaching in the black wave 4 to around 0.7430 region. After wave 4 is finished, our target for the red wave C is projected to come close to the 0.7500 area, where we will be expecting a turning point lower.

AUDUSD, 30Min