EURUSD is turning sharply lower from the 1.1300 level where the pair has finally accomplished a big and very long sideways pattern in wave IV. It was a triangle which is now completed because of a decisive break beneath the blue wave D swing at 1.0847 level four weeks ago. As such, we are now even more confident that bears may gain more momentum at the start of a new week, making a decisive breach below blue wave B. At the updated chart we can see waves 1 and 2 completed, and if that is the case then more weakness may follow in the weeks ahead into wave 3.

EURUSD, Daily

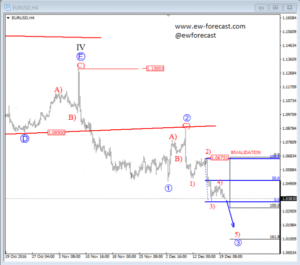

EURUSD is in a strong bear trend for the last three weeks which is looking impulsive on the 4h chart, so we believe that the big consolidation since 2015 was a triangle in wave IV, now completed at 1.1300. As such, we are looking lower into wave V which has completed its first impulsive wave as wave 1-circled, followed by a three wave A)-B)-C) correction towards the at 1.0876 level, labeled as wave 2. Now we can see the price trading lower around the 1.0383 area, after a possible resistance for red wave 4) had been found at the 1.0477 level. As such, we believe this minor correction could now be finished and more weakness may be in play into the final red wave 5) of three.

EURUSD, 4H