Today should be a busy day for the markets with a potential sharp move as we have Manufacturing PMI coming out from the UK at 09.30, then you have ADP Non-Farm Employment Change at 13:15 and ISM Manufacturing PMI at 15.00 out from US followed by Crude Oil Inventories 15mins later. The most important however, will be FOMC Statement and rates decision at 19.00GMT. We however do not expect anything new from the FED, but as always it will be tracked closely regarding hawkish/dovish tone. Trump wants a lower USD to help exporters, so I’m wondering if they will try to depreciate the dollar. Technically speaking, there is no evidences yet that downward correction on the USD is over. In fact, I have few majors here which are looking for more upside against the buck on their intraday charts.

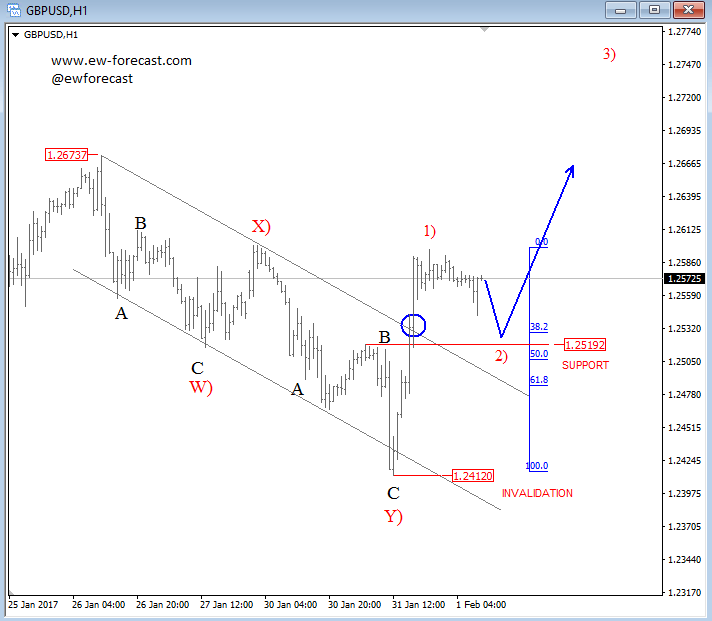

GBPUSD made a strong turn up yesterday, so it appears that was an impulse that will cause more buying today for the pound to lift it back to around 1.2673 highs. However, wave two can see another dip down to 1.2520 support before uptrend may resume.

GBPUSD, 1H

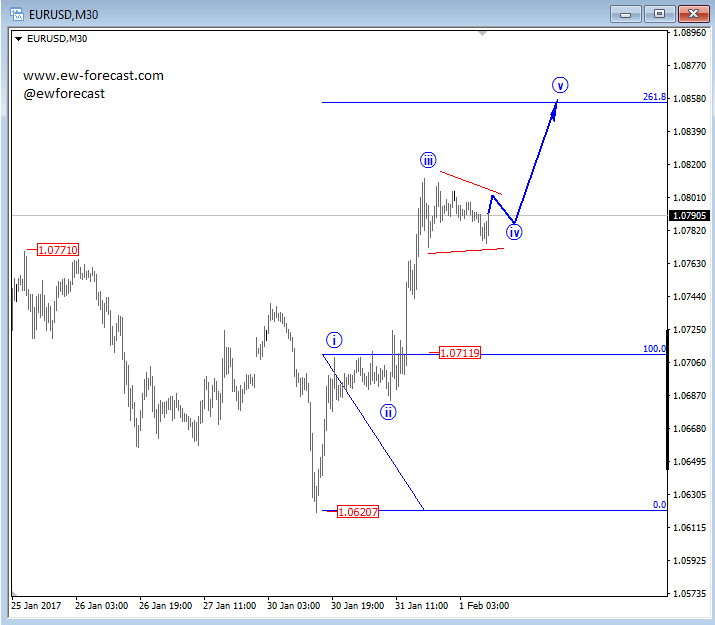

EURUSD is also turning to the upside with an impulsive price action from 1.0620 low. We see more gains in the sessions ahead as the current pause near 1.0800 looks like a correction for wave four so wave five can see a rise to 1.0850/60.

EURUSD, 1H