GBPUSD fell sharply lower last week after vote counts for EU membership showed that the UK wants to leave the Euro zone. The pair fell to a new low which was technically expected as you know since we counted the bounce from 1.3850 as a corrective fourth wave. So despite a strong leg down, traders should be aware of a turn back to the upside in the weeks ahead, since we see the price in the fifth wave of decline; the final wave of a five wave fall from 2015 high. Technically speaking 1.2800-1.3800 can be a support area for the pair.

GBPUSD, Daily

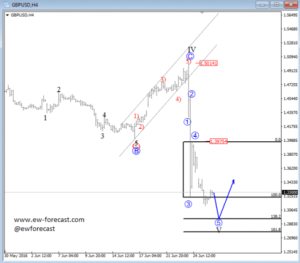

On the lower time frames, as expected, GBPUSD is trading lower after the price completed a big corrective retracement labeled as wave IV last week, and made a nice sharp turnaround lower from 1.5014. The sharp wave down came after a successful break beneath the channel support line that caused an impulsive weakness that should be made by five waves. Well, notice that the recent fall from 1.3975 already made a new low this week so we see the price in sub-wave 5 at the moment, which is a final leg within downtrend. As such, traders will have to be aware of a bounce, but the price may still reach 1.2800-1.3000 region before the bears completes the downward movement.

GBPUSD, 4H