USD was up yesterday, but some majors are already recovering the losses, with EURUSD up 70 points since yesterdays low. Commodity currencies are also acting strong, especially AUD and NOK at the moment. On the other-hand, if you want a bullish take on USD then stay against the pound which may see a drop to a new low of the week soon.

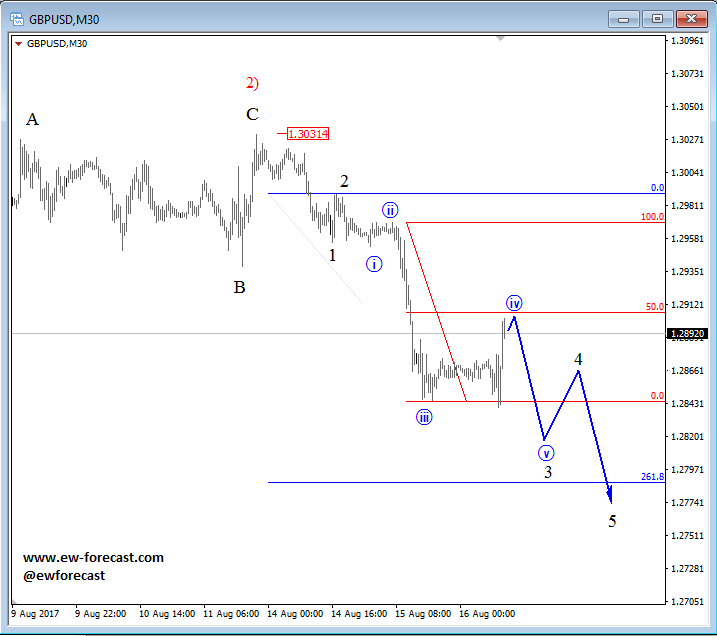

GBPUSD is in wave four so be aware of a fall into wave five down to 1.2800 this week. Resistance is at Fibonacci ratio of 50.0.

GBPUSD, 1H

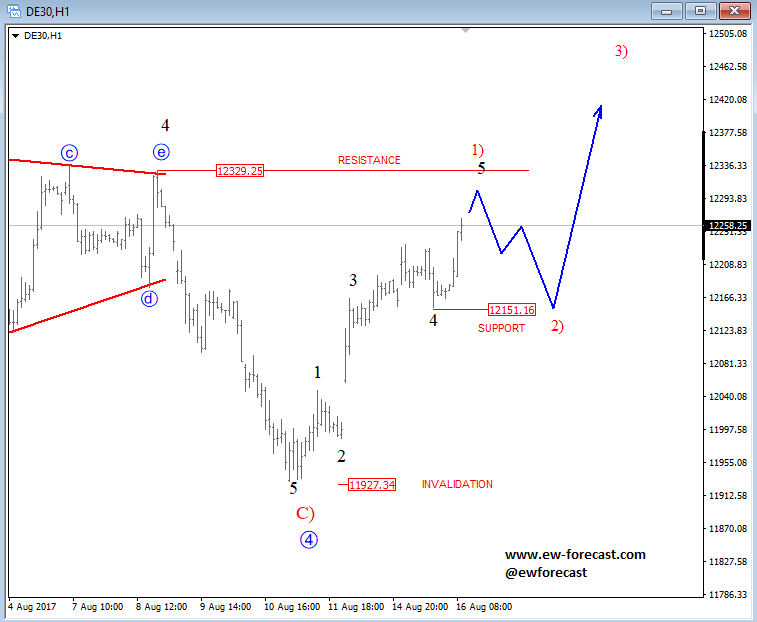

Regarding stocks, we see the market back in risk-on mode, as DAX turned up from 11927 in five waves which is a bullish structure, but we should be aware of a three wave set-back before the uptrend may resume.

German DAX, 1H