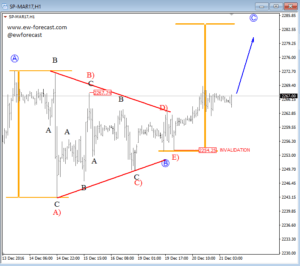

We see the stocks still in bullish mode with German DAX trading higher in wave 5 which may extend its gains up to 11550 level this week, while E-mini S&P500 should be headed higher into wave C-circled towards 2280-2290 projection. In the mean time we can expect the same unchanged flows on FX board, which means that JPY should stay under-pressure, while USD can see even higher levels against EUR, GBP; CHF and against commodity currencies.

German DAX, 30Min

S&P500, 1H

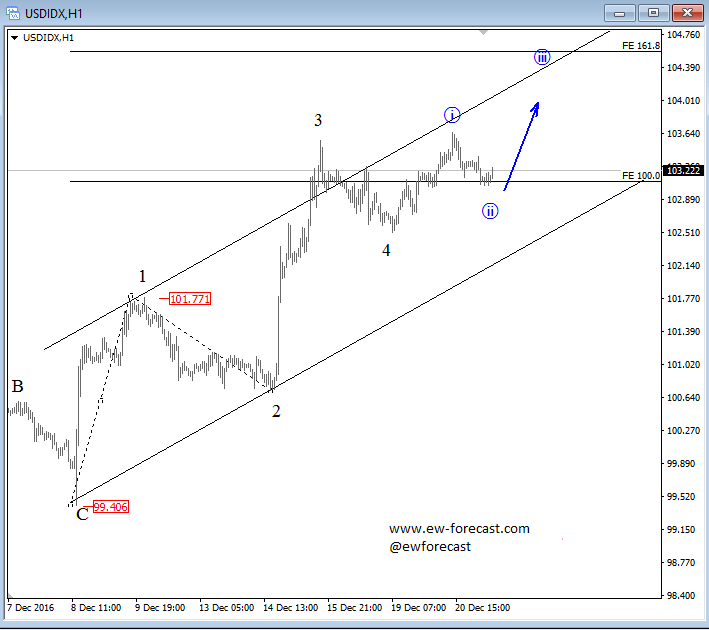

USDCHF is looking very interesting, now in a fourth wave correction, which can be a triangle so higher price will be expected after a completion of an A-B-C-D-E substructure. Technically, we will expect a leg up to 1.0400 while USD Index may see levels above 104.00.

USDCHF, 1H