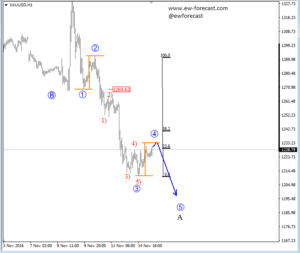

GOLD

GOLD is trading impulsively lower, probably making a five wave decline with the price now trading in an unfolding sub-wave 4- circled. This corrective wave 4 may find its resistance and a possible turning point lower around the 23.6 or 38.2 Fibonacci ratio, from where bears may again take over. Invalidation level is at 1269- as long as it holds we are looking lower.

GOLD, 1H

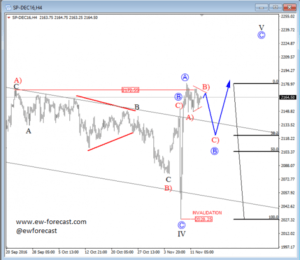

S&P500

E-mini S&P500 recovered sharply after that drop to the 2030 area where the market now shows signs of a completed three wave decline in wave IV, from August highs. Notice that the current leg up is much stronger than the previous decline, so we believe that a bigger uptrend is back in bullish mode, ideally in wave V that will be looking to hit a new all-time high. In the short-term however, be aware of a corrective set-back; ideally with wave B back to that broken channel that can become a good support next week.

S&P500, 4H