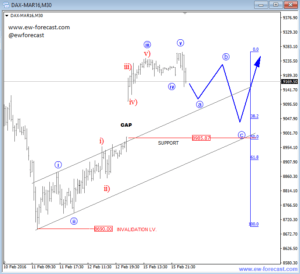

German DAX

We have been looking for lows on DAX for some time. The current price action from the lows has 5 waves up thus we expect to see an ABC pullback soon. There is a gap on this impulse structure so we expect this gap to be filled during this pullback. Levels to expect as support is around 9.000.

German DAX, 30 Min

AUDUSD

On the intraday chart of AUDUSD, we are tracking a complex correction pattern in red wave B) that could be near completion, as wave Y of the second zig-zag is in late stages. That said blue wave c-circled of wave Y can be an ending diagonal, that can push prices lower in the sessions ahead.