Stocks fell sharply last week, especially on Friday when S&P500 lost almost 2%. We have seen quite aggressive weakness but during this time, USD did not fall much, it was actually up against the commodity currencies. That said, we assume that possible bounce on stocks this week could make USD strong.

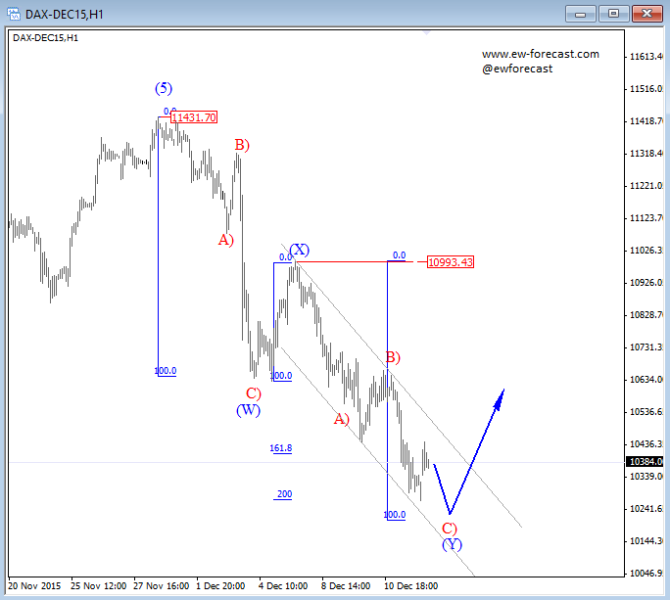

On German DAX below, we are observing a big move down from 11430 that can be counted in seven swings. That’s a number of a corrective price action so we assume it’s a double zigzag, ideally nearing a completion. We see some important Fibonacci level around 10200 that can become a good support. However, bears are still strong, so it will be important to wait on five wave bounce and broken channel line to confirm a change in trend; from current bearish to bullish mode.

German DAX, 1H

If DAX will bounce, so should USDJPY. On the updated hourly chart we see a five wave decline from December high, which means that a new bounce should occur. It should be made by minimum three waves, but ideally it will be impulsive as the current leg down from 123.67 can be wave (c) of a three wave downward correction. If the bounce will be impulsive, then we could be even considering new lows later this week.

USDJPY, 1H