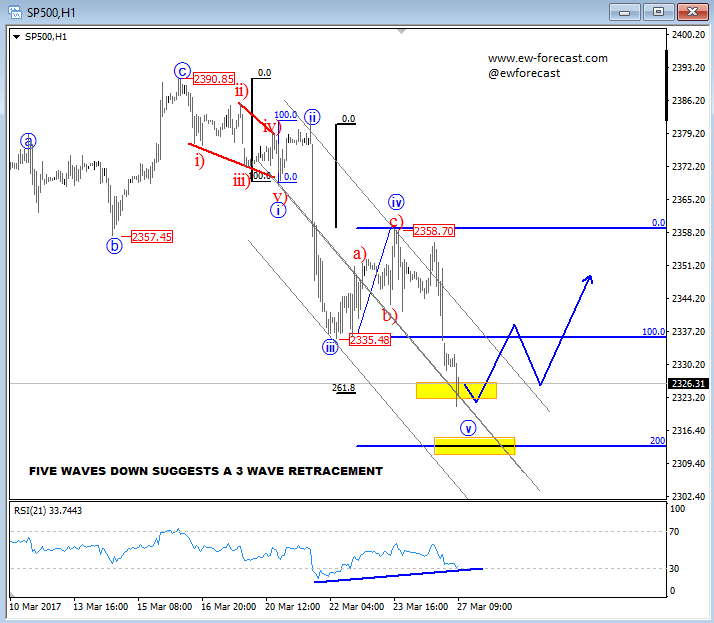

S&P500

We expect the dollar index to hit new lows of the year as EURUSD breaks above 1.0800, while stocks sold-off as Trump’s health-care bill fails. E-mini S&P500 has extended its weakness from last week down to 2320 area which was our projected zone for a fifth wave of decline, highlighted last week. The question is, what is next. Well, if you are familiar with the Elliott Wave principle, then you know that the market can be ready for a bounce this week if we consider that after every five wave trend there will be a change in three legs minimum, no matter what is the structure on a higher time-frame charts. So, from a technical perspective, and also from a psychological point of view, when others are turning aggressively bearish on stocks, we suspect that a three wave of retracement may show up on stocks, but it may be just another temporary recovery. Divergence on the RSI also indicates a potential turn. We see the first support zone here near 2320 while the next one stands near 2310.

S&P500, 1H

EURUSD

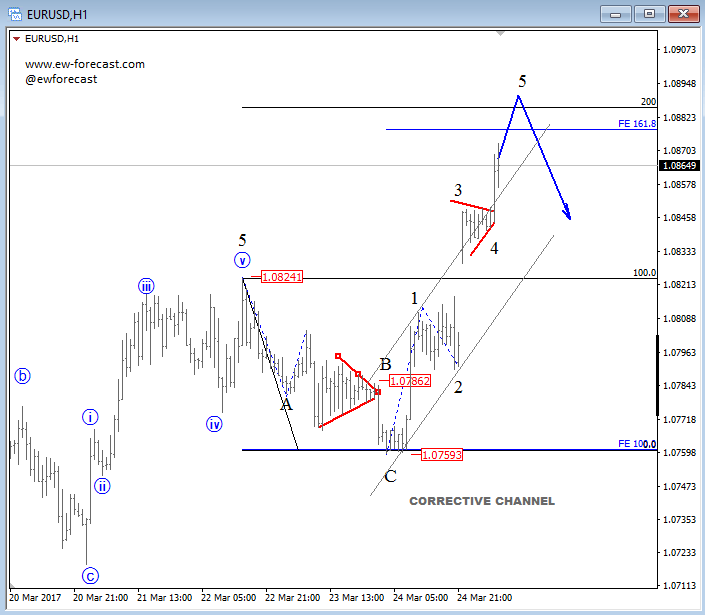

EURUSD is on the rise which we assumed would happen after only a three wave decline from 1.0824 that we labeled as a corrective move. Notice that since then, the market turned sharply higher, clearly in impulsive fashion that already shows five sub waves up from 1.0759, thus a reversal point may not be far away. Technically speaking we see a resistance at 1.0880-1.0900 region.

EURUSD, 1H