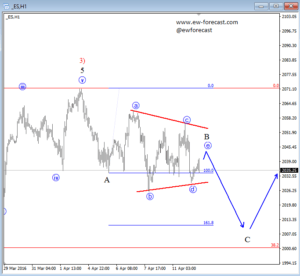

S&P500

Intraday chart, E-mini S&P500 is suggesting more downside in the short-term as the current swings suggest that wave B is a triangle. As such, we remain bearish for 2000/2012 area before the big corrective set-back can be finished.

S&P500, 1H

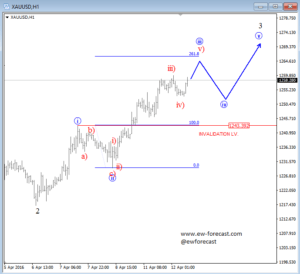

If stocks are headed even lower then we can expect higher metals, which should be supportive for EUR and AUD as well.

GOLD

Gold appears to be in a strong impulsive uptrend, now in late stages of a blue wave three that can slow down around 1265/1270 area, but only for a short-term retracement into blue wave four that can be interesting for some traders to look for buying opportunities while market trades above 1243.

GOLD, 1H