We have seen a strong drop on stock prices yesterday, which was technically expected due to a shift into wave C of a decline that belongs to big wave four. At the same time metals turned up, and JPY as well, while USD based pairs did not respond much.

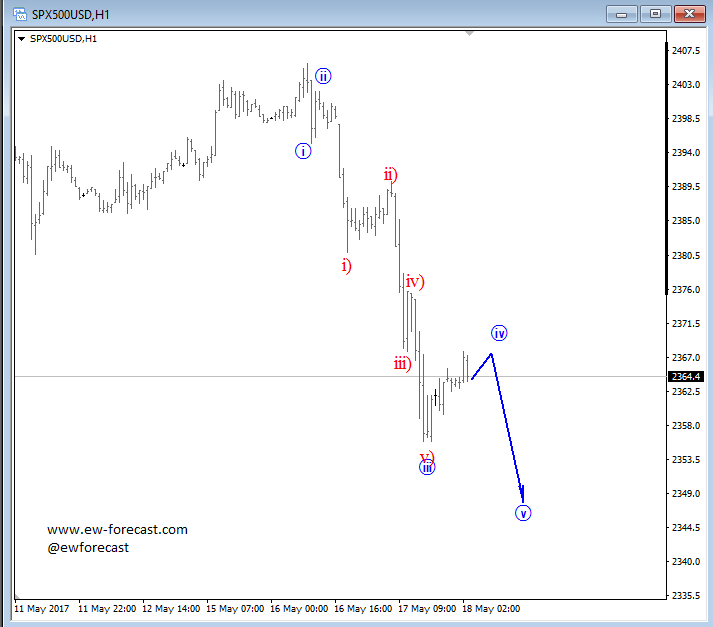

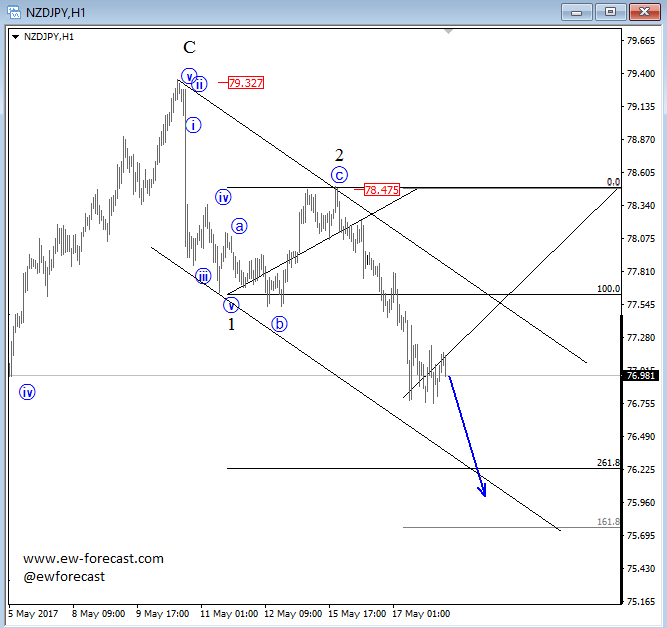

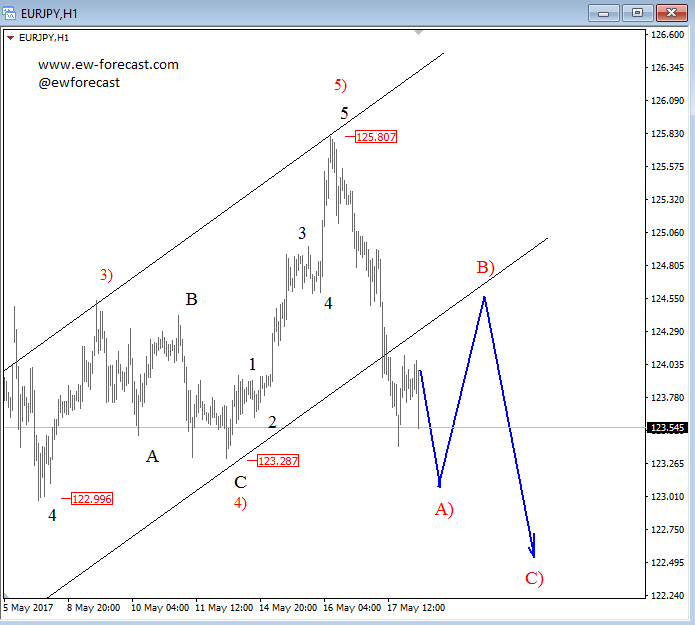

Technically speaking we see E-mini S&P500 turning down from 2400 in impulsive fashion, currently trading in wave four so another low may be seen today before the market turns up for a three wave recovery. If stocks will remain under pressure then we can expect XXX/JPY pairs to stay down as well. We are looking at NZDJPY and EURJPY with a nice bearish price action already in progress; NZDJPY for 76.00 and EURJPY for 123 in A).

S&P500, 1H

NZDJPY, 1H

EURJPY, 1H