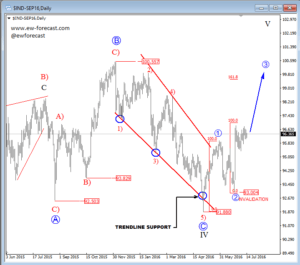

On USD index daily chart we are observing a big sideways pattern since the start of 2015; it’s slow, sideways and overlapping price action which is a personality of a contra-trend movement that can be completed now. We see it as a flat correction in black wave IV; a three wave structure where the final wave C should be made by five waves. Well, we have seen a nice decline from November of 2015 counted in five legs, but as an ending diagonal. That’s a reversal pattern that already caused a strong bounce in May, so ideally the recent sharp leg down was just a pullback labeled as wave two within an ongoing uptrend and the recent sharp turn to the upside is undergoing wave 3, which could ideally reach 99 region.

USD Index, Daily

On the lower time frame, the price made a nice reversal higher in the last few weeks from 93.00 area where a three wave set-back had completed a contra-trend move. Now we think that the price could already be in a new bullish sequence which can reach for 98.00 area, but after a completion of a red subwave 2) that can be headed back to 95.30 region for a support near 38.2% Fibo. ratio.

USD Index, 4H