Good morning traders!

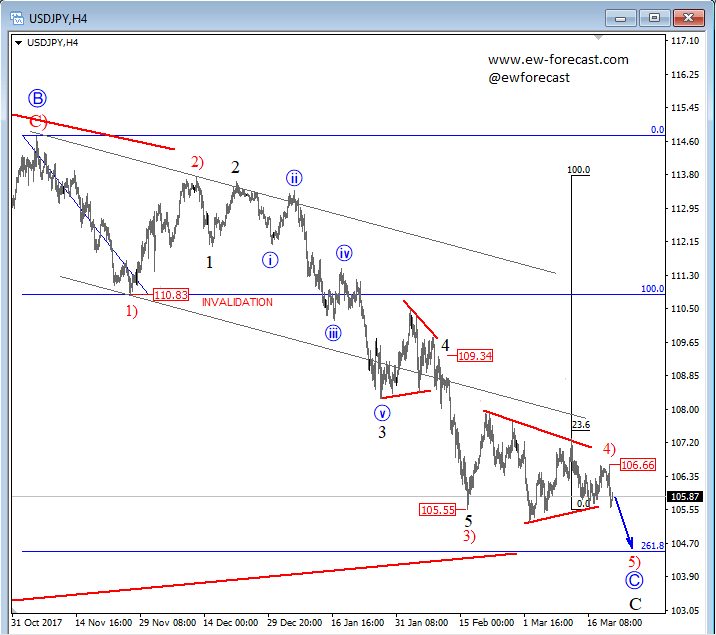

USDJPY is trading in a downtrend since the end of October 2017, which means bears can slowly start to slow down. Specifically, we see an ending price in corrective wave 4), the fourth wave of an impulse which can be unfolding in an EW triangle pattern. An EW triangle pattern is a complex correction, that usually unfolds prior to the final wave. This means once the corrective wave 4) fully show up, a new drop into wave 5) can be expected, which can later base on Fibonacci projection ratios and find a low and a reversal near the 104.5 region. A rally in five-waves from the mentioned area would suggest a low in place.

USDJPY, 4H

As we look closer, we can see that wave 5) can already be slowly unfolding.

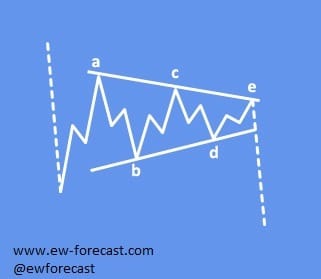

A Triangle is a common 5-wave pattern labeled A-B-C-D-E that moves counter-trend and is corrective in nature. Triangles move within two channel lines drawn from waves A to C, and from waves B to D. A Triangle is either contracting or expanding depending on whether the channel lines are converging or expanding. Triangles are overlapping five wave affairs that subdivide 3-3-3-3-3.

Triangles can occur in wave 4, wave B, wave X position or in some very rare cases also in wave Y of a combination

EW triangle pattern: