Good day traders! Today, let’s look at USDNOK and S&P500.

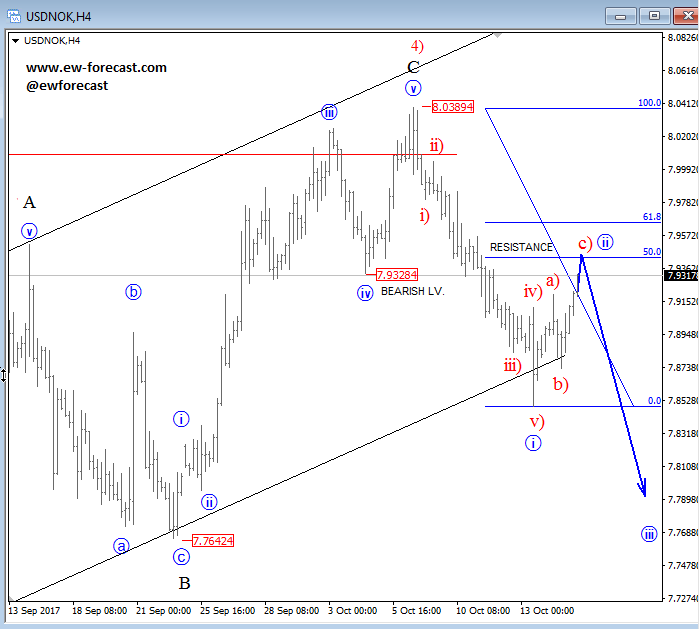

USDNOK looks very interesting, as it has a very clear wave structure; bigger three waves up followed by a bearish turn back to the channel support line, so we labeled the leg down from 8.04 as wave one which means weakness may resume soon as sub-wave two already retraced back to 7.9330 resistance.

USDNOK, 4H

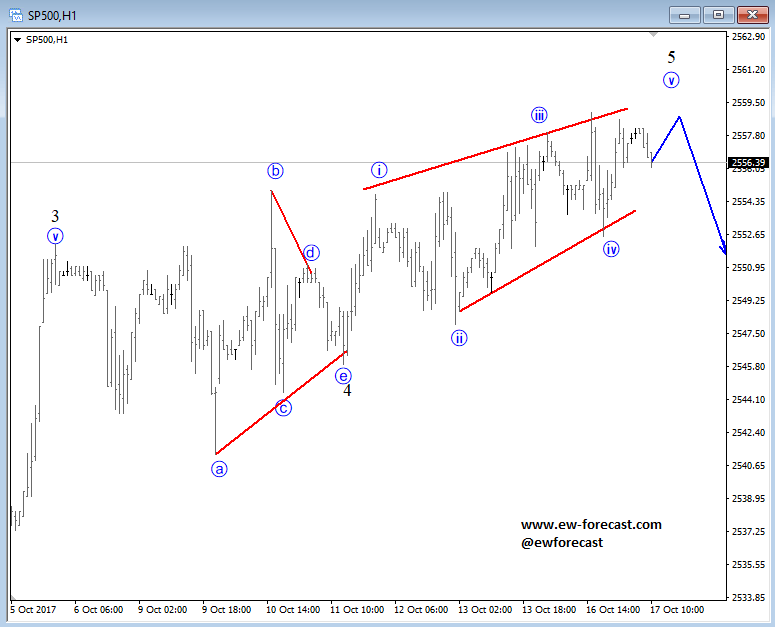

On stocks we have seen much action lately, but still higher prices on S&P500 and Dax. On E-mini there is an unfolding wedge pattern, known as an Elliott ending diagonal that can be placed in a fifth wave. That’s a very powerful pattern that may cause a strong decline if wave four swings at 2551 is broken.

S&P500, 1H