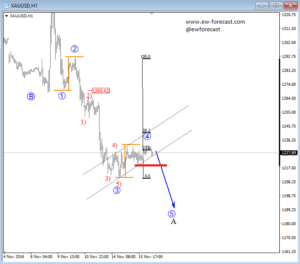

GOLD

Gold is higher, but trading slowly and with three sub-waves, so we see the recovery as wave four that belongs to a downtrend. The price already retraced the same distance compared to wave two, so it may be time for a bearish turn in the next few hours. We see room for a fifth wave fall to 1190, which may come in play once 1218 is broken.

GOLD, 1H

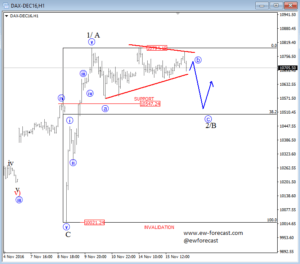

German DAX

No change on DAX. At the moment we see the price making a corrective pattern, ideally a three wave retracement down into wave 2/B that can see the 10550/10500 area, which could be an ideal support for a new turn to the upside later this week. A break and daily close above 10800 will indicate completed corrections that will open the door for 10900.

German DAX, 1H