- The slide on Friday morning took the price back to the drawing board at $6.84 (intraday lows).

- EOS key resistance stands at $7.10 (50% Fib) while the intraday supply zone at $7.16.

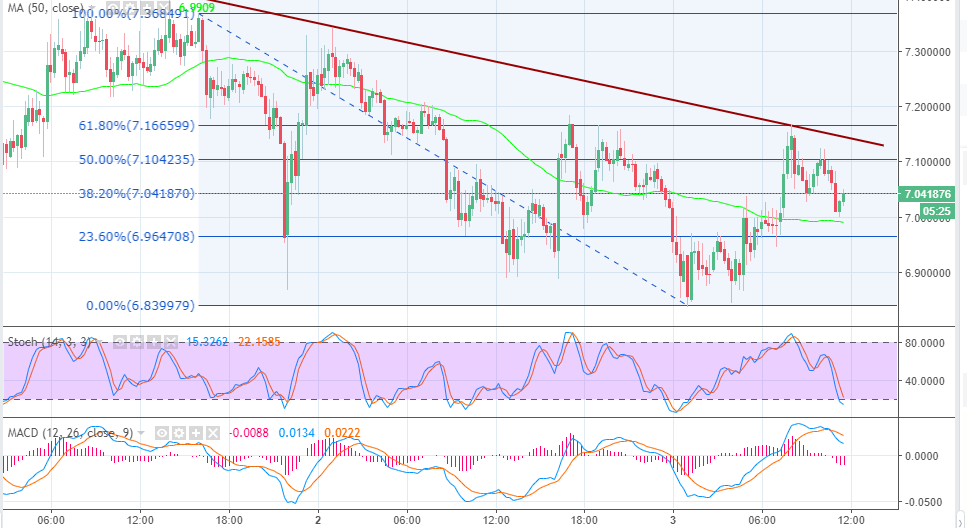

EOS has been hammered by the rising selling pressure in the market in the last few days. However, the bulls are currently saying no more and are calling for a breather from the selling pressure. The price tanked below the pivotal $7.00 level. But the slide on Friday morning took the price back to the drawing board at $6.84 (intraday lows).

The slide was, however, short-lived and an upside movement using $6.90 as a support made a breakthrough above $7.00 and exchanged hands as high as $7.15. The recoil was limited by the 61.85 Fib level between the highs of $7.38 and the lows of $6.84. Lower corrections followed suit but the critical support at $7.00 has been holding ground for the mid-morning trading session.

EOS/USD is currently changing at $7.02 while the 38.2% Fib level is restricting upward movement at $7.042. The key resistance stands at $7.10 (50% Fib) while the intraday supply zone at $7.16 is the ultimate breakout zone towards other higher supply zones at $7.3 and $7.40. On the flip side, the 100 simple moving average on the short-term 15-minutes chart will halt declines if $7.00 support is broken. Other support areas include $6.96, $6.90 as well as the demand zone at $6.84.

In other news, EOS blockchain creator Dan Larimer has proposed a new way on how the network can make use of resources, and by so doing increase efficiency and distribution. EOS currently uses CPU time and RAM resources but the distribution has not been fully explored. This means that some users, specifically small-scale users hoard resources without knowing. Dan Larimer says that EOS owners can lend their unused tokens at a fee to other entities willing to expand their bandwidth. Larimer says:

“Token holders can lend their EOS at a fee in exchange for some loss of liquidity for the duration of the loan. There is no risk of losing capital to the lender.”

The loan, in this case, is without any financial risks because it is simply a technicality that allows an entity to utilize the specified CPU power. Dan Larimer adds:

“A EOS holder can lend their tokens to the Resource Exchange and will receive REX tokens for their EOS at the current book value of the Resource Exchange. The REX will generate fees by lending the EOS which will increase the book value. At any time the holder of REX tokens can convert REX back to EOS at book value.”

EOS/USD 15-minutes chart