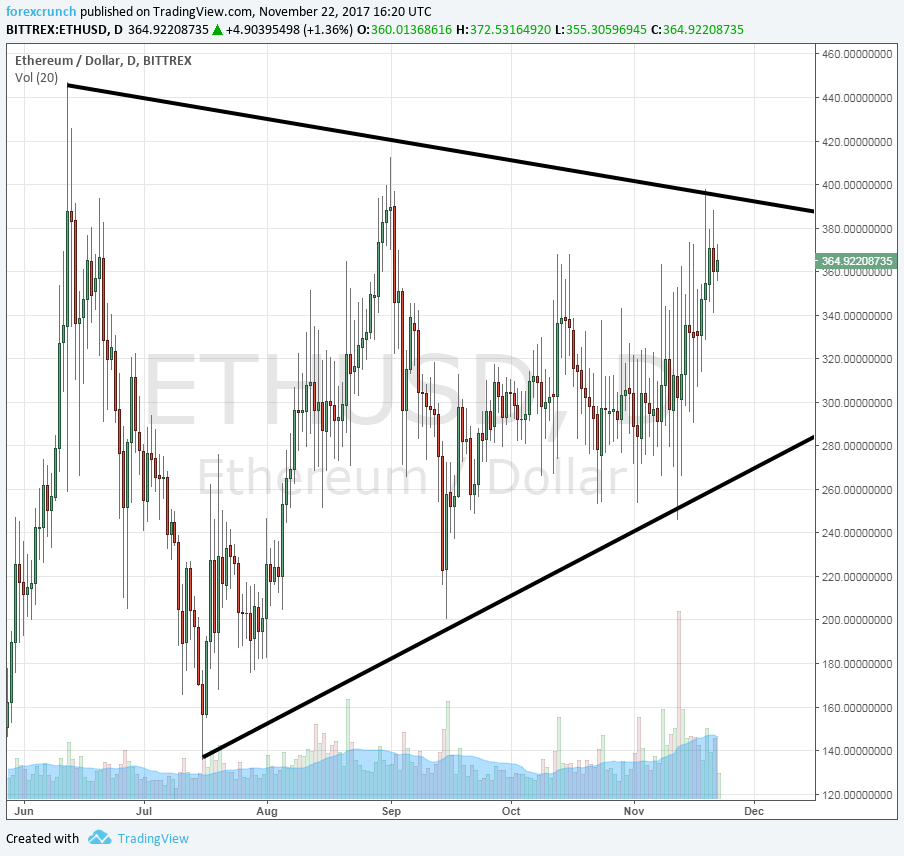

Should we look to higher lows or lower highs? The price of Etherium is trading in a narrowing wedge or triangle. The peak price of $446 was recorded in early June. From there, the pair dropped all the way to $140 in mid-July. Both lines are the extremes of the triangle and from there we are seeing lower highs and higher lows.

A lower high of just under $420 was seen in August and it was followed by a failed attempt to recapture $400. But the price never fell back to the low levels of July. The first higher low in September was already $200 and the most recent one in November stood at $260.

With Etherium trading becoming somewhat more rational and more prone to technical analysis, we can expect the range to narrow. To where? This is hard to tell. But, the textbook assumes that once we have a breakout, it will be wild and will create a clear trend.

Cryptocurrencies are gaining ground in the public and becoming more mainstream. The elevated interest implies rising prices: a break to the upside from the current levels of around $365 implies a move towards resistance at $446, that all-time high. For that, the coin will need to break the downtrend resistance line which currently stands at $390.

Yet the growing interest also attracts scrutiny, first and foremost from regulators and may trigger a sell-off. The downside from current levels seems to have more room in the longer-term, but further support in the shorter-term, with uptrend support awaiting around $280.

Do you trade the Etherium crypto-currency? Where do you think the price will go next?