- ETH bulls gear up for a fresh leg higher.

- Falling wedge breakout confirmed on the 4H chart.

- RSI stays bullish, a test of the $600 mark inevitable.

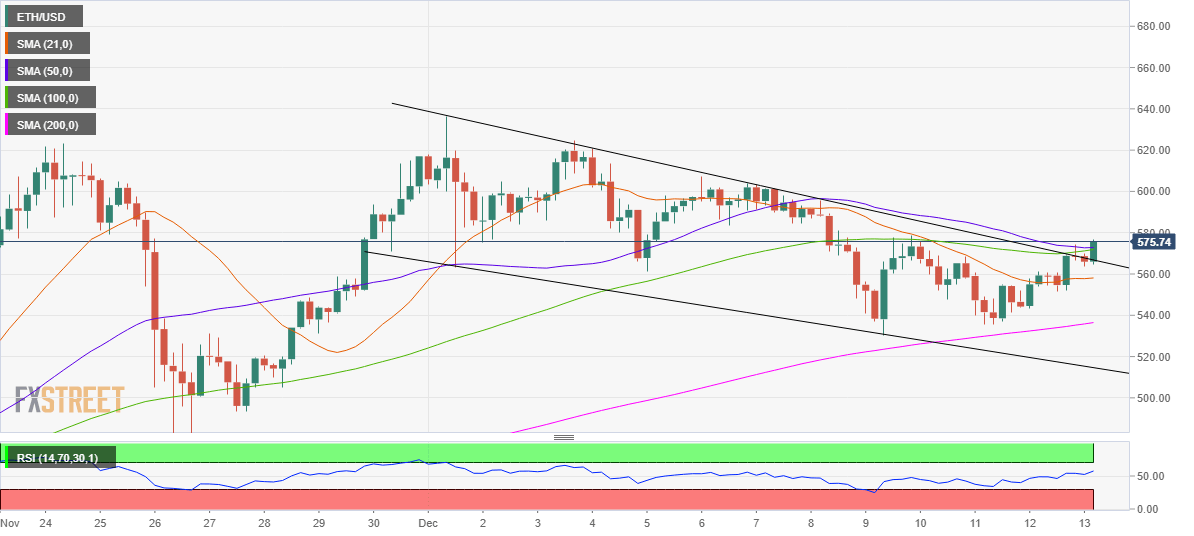

ETH/USD is building onto Saturday’s recovery, as the bulls look to regain the $600 threshold amid a favorable technical setup on the four-hour chart.

ETH/USD: 4-hour chart

The price has finally dived out of the two-week-old falling wedge formation, confirming a breakout on a close above the pattern resistance of $567.

The upside break also prompted the bulls to clear a critical resistance of $572, which is the confluence of the 50-simple moving average (SMA) and 100-SMA.

Acceptance above the latter opens doors for a test of the $600 mark. Buyers will then target the December 1 high of $636.53.

The Relative Strength Index (RSI) points north, now standing at 57.71, indicating the additional upside remains on the cards.

On the flip side, immediate support is seen at the horizontal 21-SMA at $558.

The next significant cushion awaits at $536, which is the upward-sloping 200-SMA.

ETH/USD: Additional levels to watch