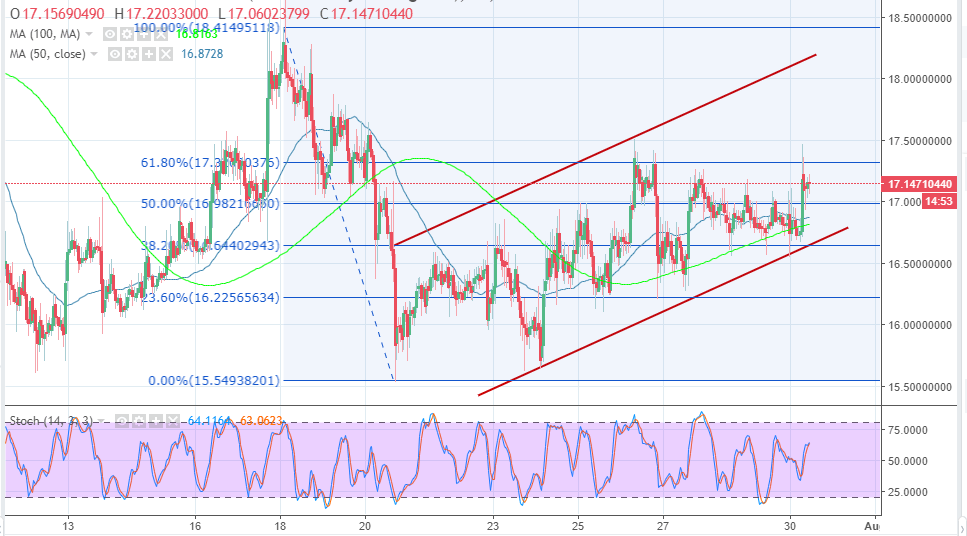

- Ethereum Classic is still range-bound between key Fib retracement levels.

- Several supports area are highlighted on the chart at the 50% Fib level, both 50 SMA and 100 SMA.

Ethereum Classic is one of the few digital assets trading in the green on Monday. Most of the cryptocurrencies have engaged reverse gears and are trimming gains. ETH/USD is up 1.26% on the day while trading within an ascending channel as observed in the chart below. Towards the end of last week’s trading, Ethereum Classic declined below the 23.6% Fib retracement level with the last swing high of $18.41 and a swing low of $15.54. The buyers entered above $15.50 pulling the price past the resistance at $16.50.

There was another upside movement on Friday last week, but it ran into bear pressure marginally above the 61.8% Fib level between the highs of $14.41 and lows of $15.54 at$17.3. Ethereum Classic has been capped below this level ever since. ETC/USD has been up and down the support the pivotal $17.00.

Significantly, Ethereum Classic has corrected lower in spite of the bear pressure in the market. The price is retesting the immediate key resistance at $17.2, but the buyers have $17.5 and $18.0 upper supply zones in sight. On the downside, $17.00 coincides with the 50% fib and is working as an immediate support level. The 50 and the 100 simple moving averages on the hourly chart will also prevent declines in the event the above support is broken. Moreover, the ascending channel will also hold the price above $16.50.

ETC/USD 1-hour chart