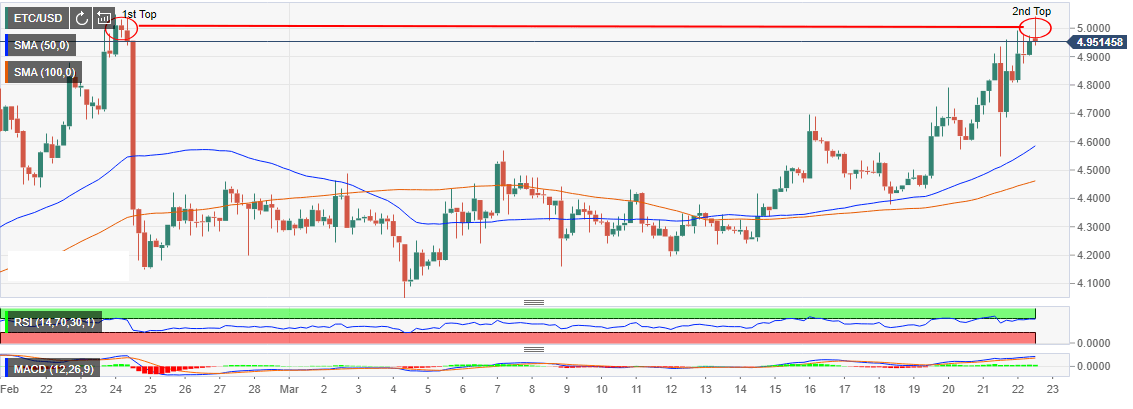

- Failure to extend the gains higher above $5.00 has led to the formation of a double-top pattern.

- The short-term outlook shows that ETC/USD is bearish.

Ethereum Classic is among the daily biggest single-digit gainers as traders usher in the weekend trading session. The gains come after the declines that swept across the market yesterday. ETC/USD has from March 15 traded higher highs and higher lows. However, the bullish momentum fizzled out at $4.9 on Thursday 21. The short-lived trend paved the way for the bears as they increased their entries leading to a slide that tested $4.55.

The buyers did not, however, stay down for long as they staged a reversal that broke above $5.0 for the first time in March. According to the data provided by FXStreet cryptocurrency live rates, ETC/USD has added 2.82% to its value to exchange hands at $4.95.

Failure to extend the gains higher above $5.00 has led to the formation of a double-top pattern. This pattern is considered as a bearish pattern and mostly signifies a trend reversal. Therefore, we can expect Ethereum Classic to trim the gains in reaction to the pattern. The short-term outlook shows that ETC/USD is bearish. However, considering the signals from indicators like the RSI and the MACD, the buyers still have control.

ETC/USD 4-hour chart