- Ethereum trends 0.27% lower on Wednesday: A setback to the bulls who hoped to push ETH/USD above $140.

- The confluence detector tool shows a lack of strong support levels for ETH/USD in the coming sessions.

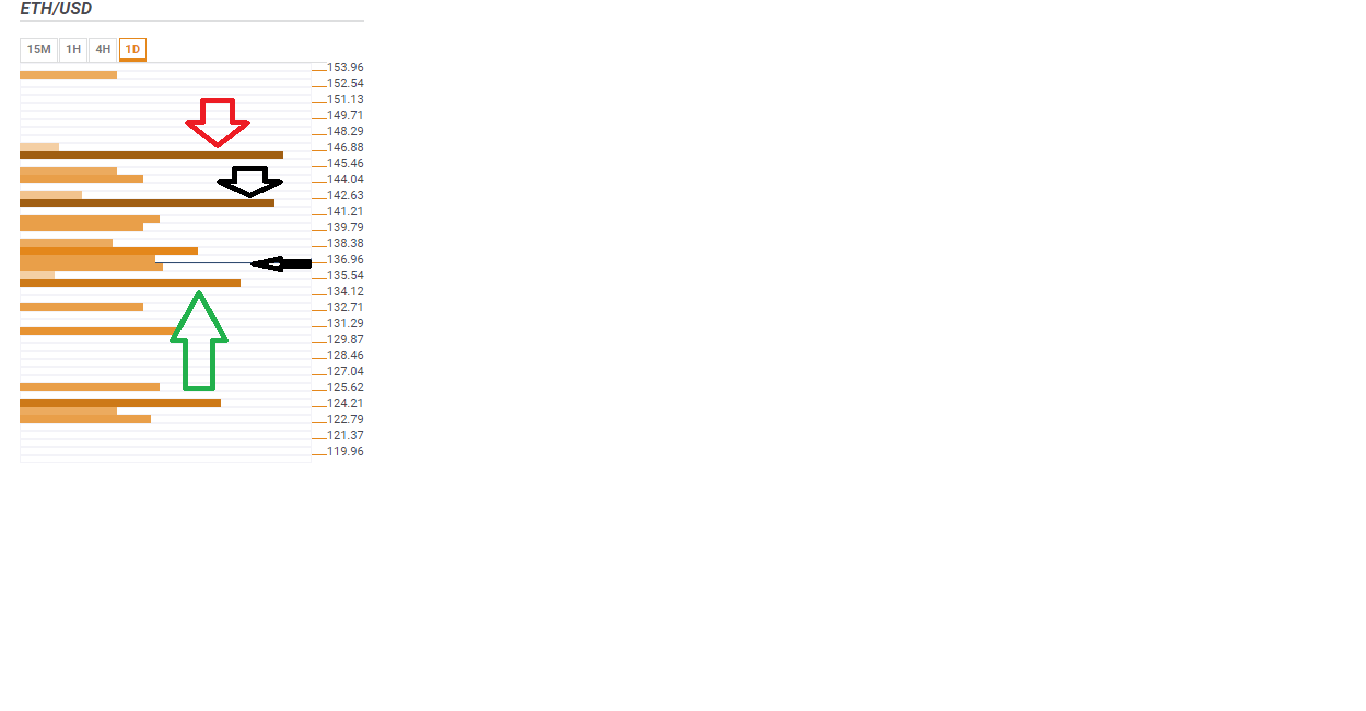

Ethereum has lost 0.27% on the day after correcting lower from $137.17 to $135.35. The retracement is a significant setback to the bulls who were psychologically prepared to push the price above $140. Moreover, the confluence detector tool shows a lack of strong support levels for ETH/USD in the coming sessions. On the contrary, the trip towards the highs traded last week around $167 will be an uphill task considering the strong resistance levels.

Technical confluence resistance levels

Looking at the confluence detector tool, Ethereum must brace itself to deal with the resistance at $138.38 – $139.79, $141.21 – 142.63 and the strongest hurdle at $145.46 – $146.88.

These are the confluences at these levels:

$138.38 – $139.79: Bollinger Band 1 hour Upper, the 4-hour 10-day Simple Moving Average (SMA), the SMA 200 15-minutes, the hourly 50 SMA, the daily previous high and the daily pivot point R1.

$141.21 – 142.63: Weekly 38.2% Fibonacci retracement level, the daily pivot point R2 as well as the daily 161.8% Fibonacci retracement level.

$145.46 – $146.88: The hourly 100-SMA, the weekly 23.6% Fibonacci retracement, the monthly pivot point R1, 4-hour chart 50-SMA, and the1-hour chart 200-SMA.

Technical confluence resistance levels

A broader look shows ETH/USD will find support at $135.54 – $134.12, $132.71 – $129.87 and $125.62 – $122.78.

The Confluences at these levels include:

$135.54 – $134.12: The 4-hour 100-SMA, the weekly 61.8% Fibonacci retracement, the daily chart previous low and the daily chart pivot point S1.

$132.71 – $129.87: Daily chart Bollinger Band Middle curve, the daily range pivot pint S2, the weekly pivot pint S3, and the monthly pivot pint S1.

$125.62 – $122.78: Monthly 38.2% Fib level, the daily 50-SMA, and the 1-week previous low.

ETH/USD daily confluence detector