- A move above $170.00 will improve the short-term technical picture.

- The significant support is created on approach to 160.00.

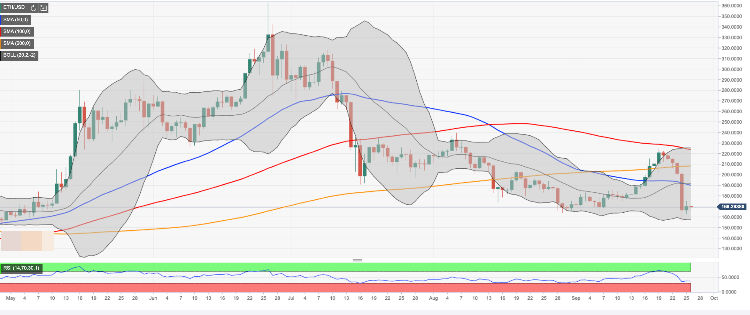

The second-largest cryptocurrency with the current market capitalization of $18.3 billion has been moving in a tight range as the recovery from the recent low stopped short of $170.00. At the time of writing, ETH/USD is hovering around $169.70, unchanged since the beginning of the day and 1.3% higher from this time on Wednesday. The coin has lost nearly 18% on a week-on-week basis.

What’s going on

Ethereum’s network is getting closer to a major upgrade know as Istanbul hard fork. The developers’ team postponed the upgrade several times due to different reasons; however, now it is scheduled to start on October 2 with the fork of the leading test network Ropsten. The testnet Rinkeby will be upgraded on November 13.

Ethereum’s long-term technical picture

Looking technically, ETH/USD needs to recover above $170.00 to mitigate the initial pressure and extend the upside movement towards the next barrier created by SMA50 (Simple Moving Average) on a daily chart that coincides with psychological $190.00. It is closely followed by the middle line of one-day Bollinger Band at $191.50. Once it is out of the way, the upside is likely to gain traction with the next focus on the ultimate bull’s target of $200.00.

On the downside, a retreat towards Wednesday’s low of $162.50 will worsen the short-term technical picture and push the price below $160.00 and towards $155.62. The next bears’ target comes at $150.00, which is the lowest level since April. It is followed by the lower line of weekly Bollinger Band at $142.50.