- ETH/USD has gained 4% in recent 24 hours and hit $264 during early Asian hours.

- The nearest local support for the coin is seen at $255.

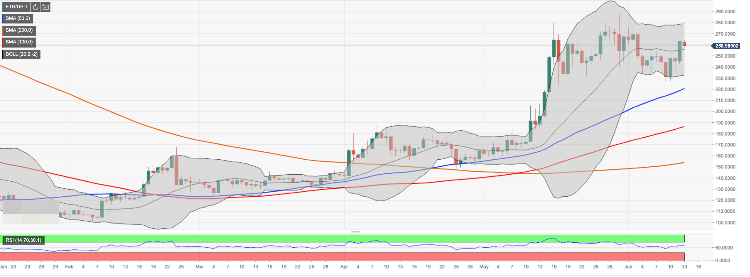

Ethereum (ETH) has hit $264 high during early Asian hours before retreating to $259 by the time of writing. The second largest cryptocurrency with the current market capitalization of $27.5 billion has gained over 4% in recent 24 hours and lost 1.2% since the beginning of Tuesday. An average daily trading volume for ETH is registered at $8.7 billion, which is higher from the long-term figures.

Looking technically, ETH/USD is now supported by $255. This barrier is created by a confluence of the middle line of 1-day Bollinger Band and SMA100 (Simple Moving Average) 4-hour. Once it is cleared, the sell-off may be extended towards $245.00 (SMA200, 4-hour) and the lower boundary of 4-hour Bollinger Band. A sustainable move below this handle will trigger more selling and push the price down to $217 (SMA50 – Simple Moving Average, daily chart) and psychological $200.00.

On the upside, ETH/USD recovery is capped by the upper line of 4-hour Bollinger Band at $262. This barrier is followed by the intraday high of $264. Once it is cleared, the upside is likely to gain traction with the next aim at $268 (the upper boundary of 1-week Bollinger Band) and $278.00 (the upper limit of 1-day Bollinger Band). T

ETH/USD, 1-day chart