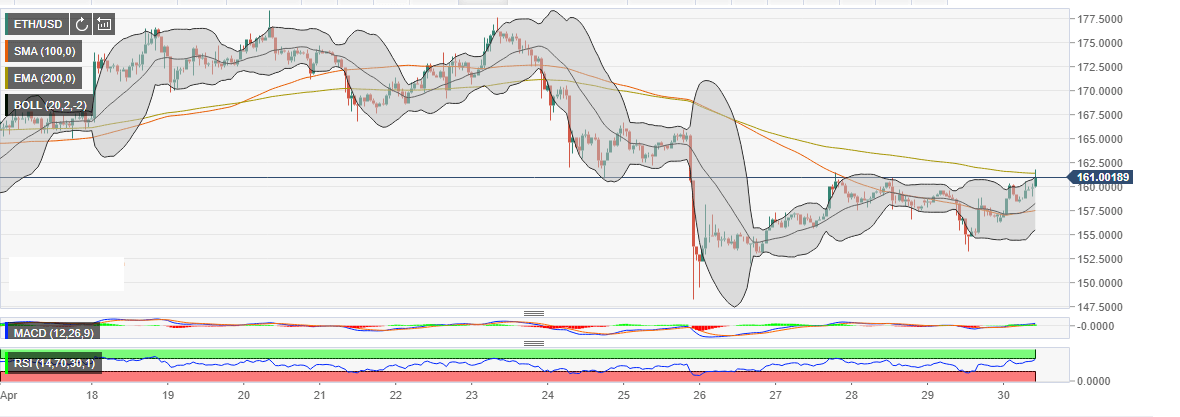

- The RSI shows a stronger bullish momentum following the steady recovery from the region below 30.00.

- ETH/USD is supported by the 100 Simple Moving Average SMA) 1-hour precisely at $157.50.

Ethereum is part of the cryptocurrencies taking advantage of the bullish wave sweeping across the market on Tuesday. Following a 2.5% rise on the day, ETH/USD has jumped $160 hurdle to exchange hands at intraday highs of $161.81. However, there has been a slight retracement to the current $160.78.

Immediately above the current market value, Ethereum is facing resistance at the EMA100. According to the technical indicators, the price is still primed for an upward move, although technical analysis shows that sideways trading is the most likely move in the short-term.

Read more: Cryptocurrency market update: Green shoots sprouting as Bitcoin, Ripple and Ethereum find stability

Meanwhile, the Relative Strength Index (RSI) came short of the oversold and current falling into a range at 65. The trends of the RSI also show a stronger bullish momentum since it has steadily recovered from the region below 30.00. While the Moving Average Convergence Divergence (MACD) has crossed into the positive region, it still holding tight to the mean level (0.0000) to show that the path of least resistance is mostly to the downside.

On the downside, the largest altcoin is supported by the 100 Simple Moving Average SMA) 1-hour precisely at $157.50. The Bollinger Band 1-hour lower is also offering support at $155 while other buyer congestion zones include $152.50 and $147.50.

You might also like: Nasdaq’s Global Index Data Service to support Ripple (XRP) index from May 1

ETH/USD 1-hour chart