- Ethereum corrects lower 13.6% from April 2019 highs.

- Ethereum escaped one range resistance only to fall into another whose upside was capped at $176.62.

- The demand zone is strong enough to hold off any dips below $160 in the short-term.

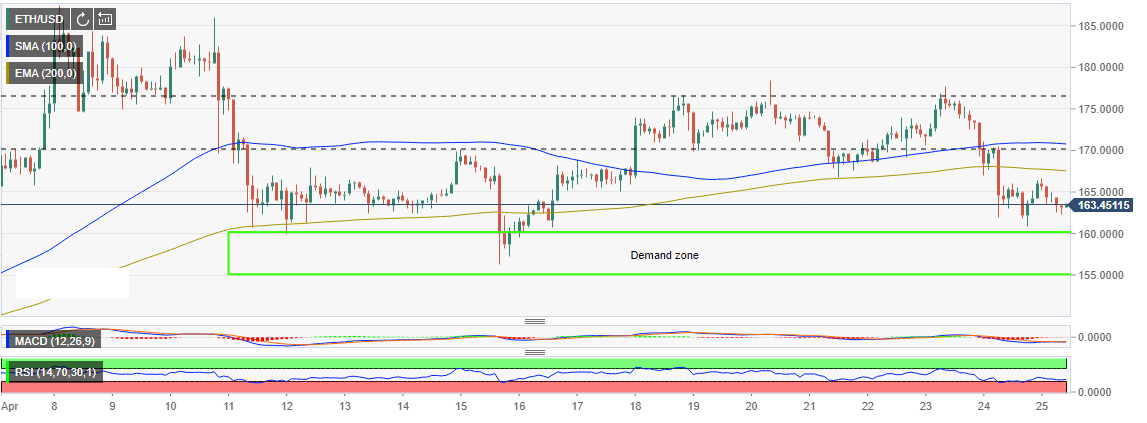

ETH/USD has continued to correct lower from the highs posted in April. The asset has lost 13.6% of its value in April alone. Attempts to recover and resume the uptrend towards $200 have been thwarted by selling pressure. In two occurrences the demand zone between $155 and $160 has worked as a key rebound area.

On April 18, Ethereum bulls pushed for a correction above the initial range limit at $170. However, Ethereum escaped one range resistance only to fall into another whose upside was capped at $176.62. Following several days of consolidation above the 200 EMA 2-hour, ETH/USD was caught up in the bear pressure on the market on Wednesday leading to a plunge not only below $170 but also next support target at $165. This time, the price formed a low at $161.01 and while taking advantage of the demand zone commenced the current consolidation phase.

At the moment, ETH/USD is trading at $163.21 and facing immediate resistance at $165. If the growing bullish momentum breaks above the initial resistance, the 200 EMA hurdle will hinder growth. Similarly, as long as Ethereum stays below the 200 EMA, the bears will continue to have an upper hand. Fortunately, the demand zone is strong enough to hold off any dips below $160 in the short-term.

ETH/USD 2-hour chart