- Ethereum bullish trend is gaining ground.

- ETH/BTC reached the highest level since June 24.

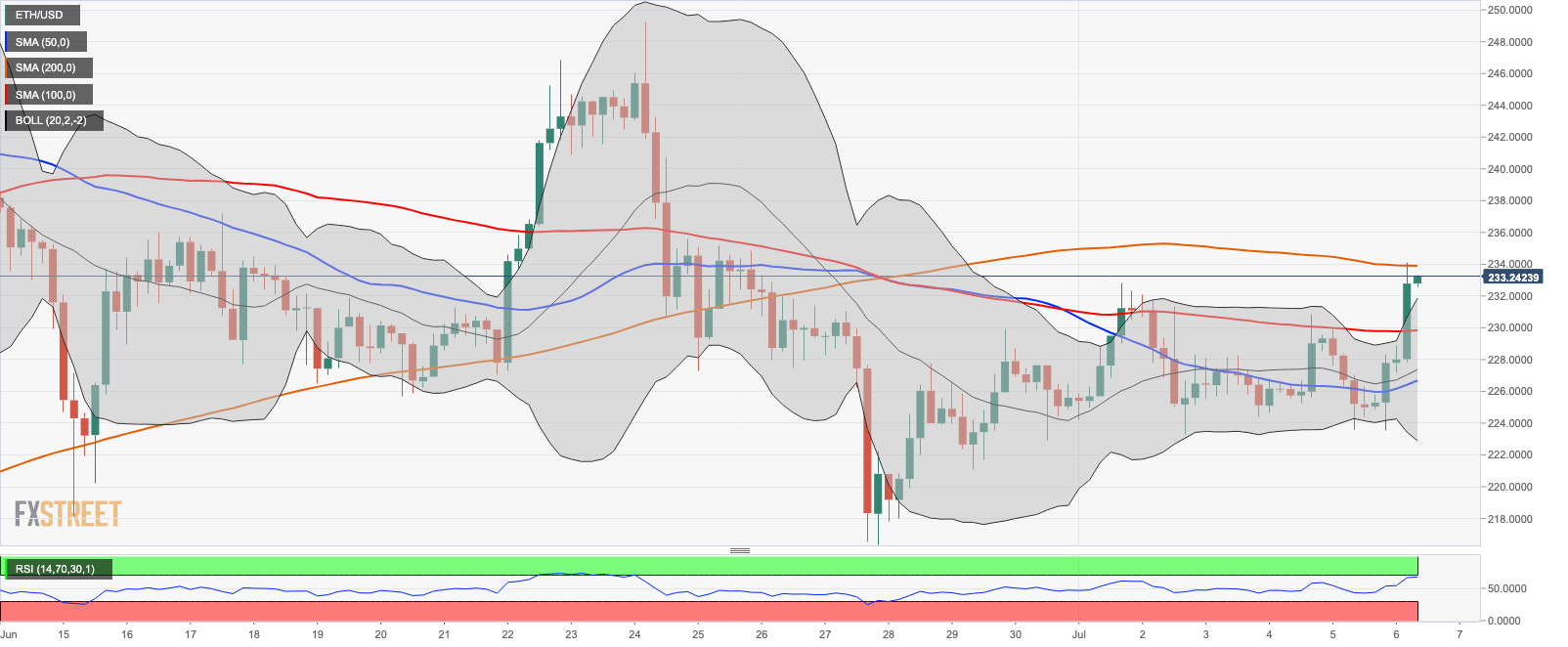

Ethereum (ETH) is gaining ground both against USD and BTC. The second-largest digital asset with the current market value of $25.7 billion is changing hands above $230.00 after a short-lived attempt to break above $234.00 during early Asian hours. While the upside momentum has faded away, the recovery may be resumed later during the day.

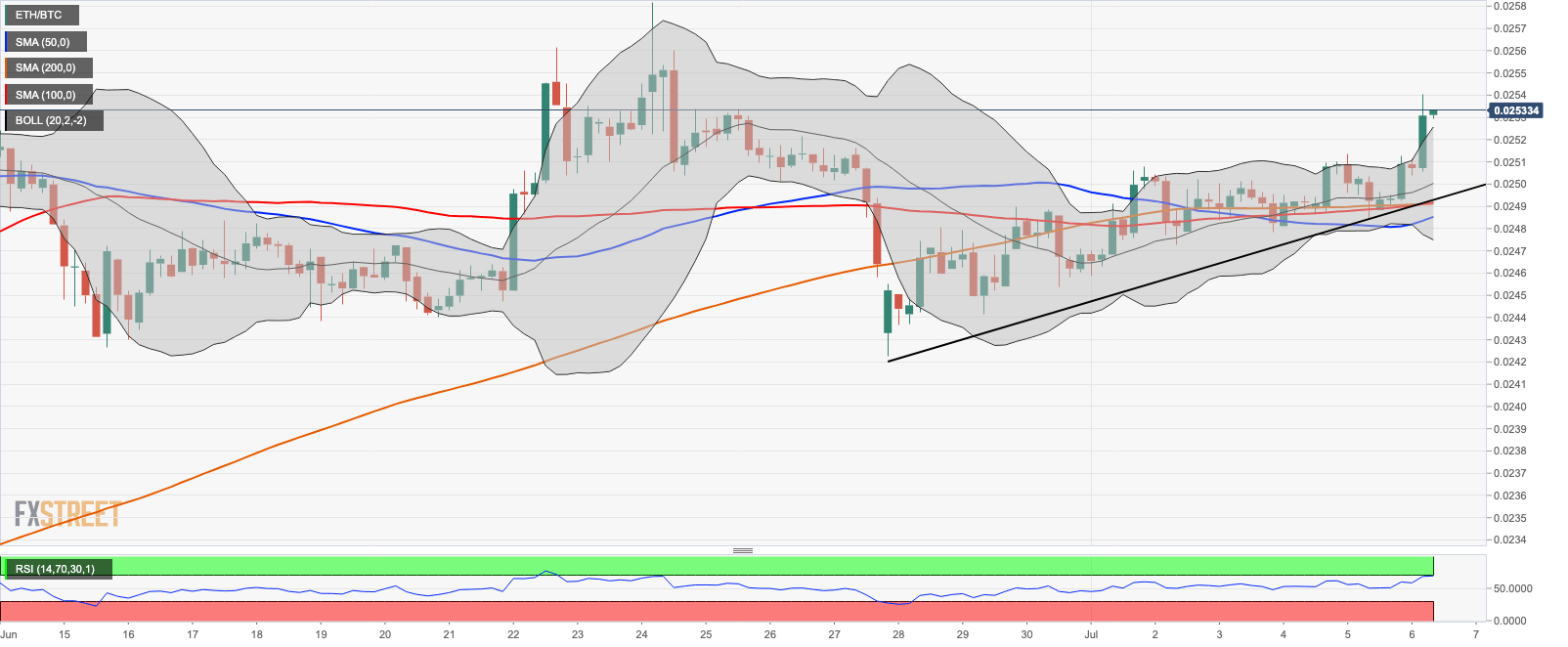

ETH/BTC: The technical picture

ETH/BTC bottomed at $0.02442 on June 27 and has been clawing background ever since. On Monday, July 6, the coin hit $0.2540, which is the highest level since June 24. On the intraday chart, the coin remains bullish as long as it stays above the upside trend line at $0.0249. Notably, this barrier is reinforced by a combination of 4-hour SMA100 and SMA50. If it is broken, the sell-off may be extended towards $0.02442.

ETH/BTC 4-hour chart

According to Intotheblock data, ETH is closely correlated to BTC. At the time of writing, the correlation ratio is 0.94, where 1.00 means that the coins move in lockstep. Notably, the price increase registered during recent days has not resulted in the increased correlation, which may be interpreted as ETH relative strength against BTC.

ETH/USD hit the intraday high at $233.90 and retreated to $233.17 by press time. The recovery stopped on approach to 4-hour SMA200, thus a sustainable move above this area is needed for the upside to gain traction. The next upside barrier comes as high as $249.26, which is the recent recovery high reached on June 24.