- ETH/USD drops over 2.0% while snapping five-day uptrend.

- An ascending trend line from November 24 offers immediate support.

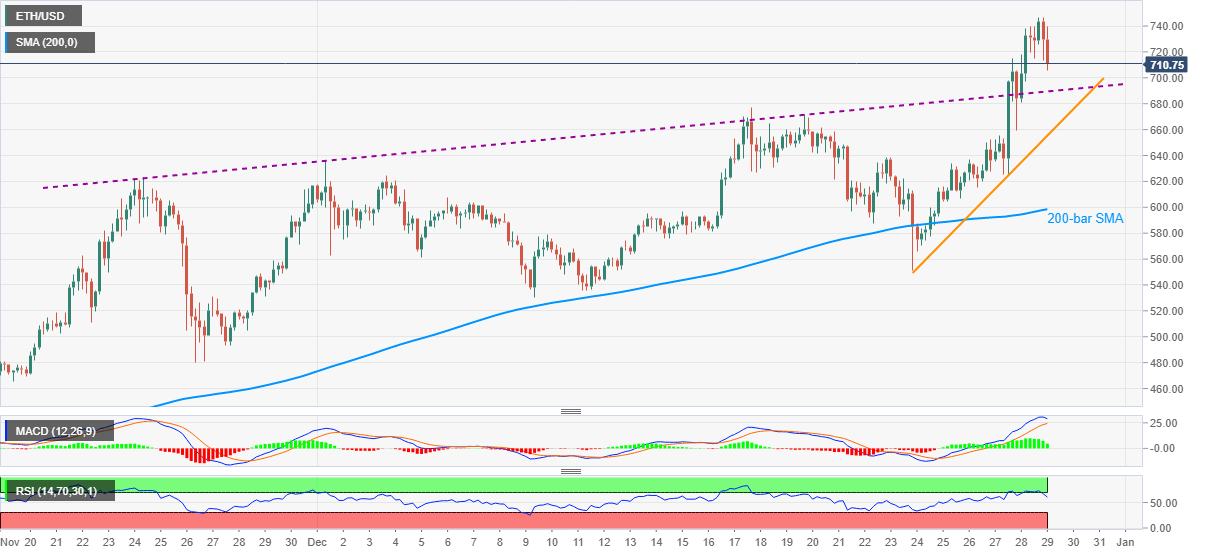

- Sustained trading beyond 200-bar SMA, bullish MACD favor buyers.

ETH/USD consolidates gains from last Thursday while declining to $710.53, down 2.58% intraday, during early Tuesday. Although overbought RSI conditions triggered the crypto major’s pullback from a 31-month high, bullish MACD and a five-week-old ascending trend line favor the bulls. Even so, the quote’s latest weakness eyes the $700 round-figure as imminent support.

As a result, ETH/USD buyers may look for a fresh position around the stated trend line support near $690.

While the recent top near $750 can lure the bulls entering around $690, May 2018 high near $830 can become their ultimate short-term target.

In a case where the ETH/USD keeps rising past-$830, February 2018 peak surrounding $985 and the $1,000 will gain the market’s attention.

Alternatively, the pair’s downside break of the stated support line close to $690 can take rest near December 17 top of $677.

Should ETH/USD sellers keep the reins past-$677, the weekly trend line support near $650 and 200-bar SMA close to $599 will be the key.

ETH/USD four-hour chart

Trend: Bullish