- ETH hit a new high of 2020, however, the bullish potential is not exhausted yet.

- A move above $780 will open up the way to $1,000.

ETH hit a new record for 2020 and reached the highest price since May 2018 at $658 fuelled by ETH futures launch on CME and a strong Bitcoin rally to a new all-time high.

At the time of writing, Ethereum (ETH) is trading at $645. The coin has gained over 10% on a day-to-day basis. The second-largest digital asset with the current market capitalization of $73 billion registered an average daily trading volume of $17 billion.

ETH lived through a stellar November and may be in for a strong December as fundamental and on-chain metrics imply that the bullish momentum is not over yet.

CME futures is a big thing for ETH

The biggest US-based exchange for trading derivative instruments will launch Ethereum futures in February 2021 to cater to institutional investors’ growing interest. This move proves that ETH is a rising star of the investment community who look to diversify its cryptocurrency portfolios.

Commenting on the news, Tim McCourt, the CME Group Global Head of Equity Index and Alternative Investment Products, said:

Based on increasing client demand and robust growth in our Bitcoin futures and options markets, we believe the addition of Ether futures will provide our clients with a valuable tool to trade and hedge this growing cryptocurrency.

Considering a success with Bitcoin futures, CME Group might expect similar interest in the Ethereum-based alternative.

Ethereum’s on-chain metrics send bullish signals

The total number of addresses with a balance exceeded 50 million for the first time in history. Moreover, according to Intotheblock, it is the first crypto-asset to reach this milestone.

ETH addresses with a non-zero balance

This is a significant milestone for the asset as it means that the number of holders is growing. In the long run, it is a positive signal as it implies a more robust and growing user base.

The road to $780 is clear

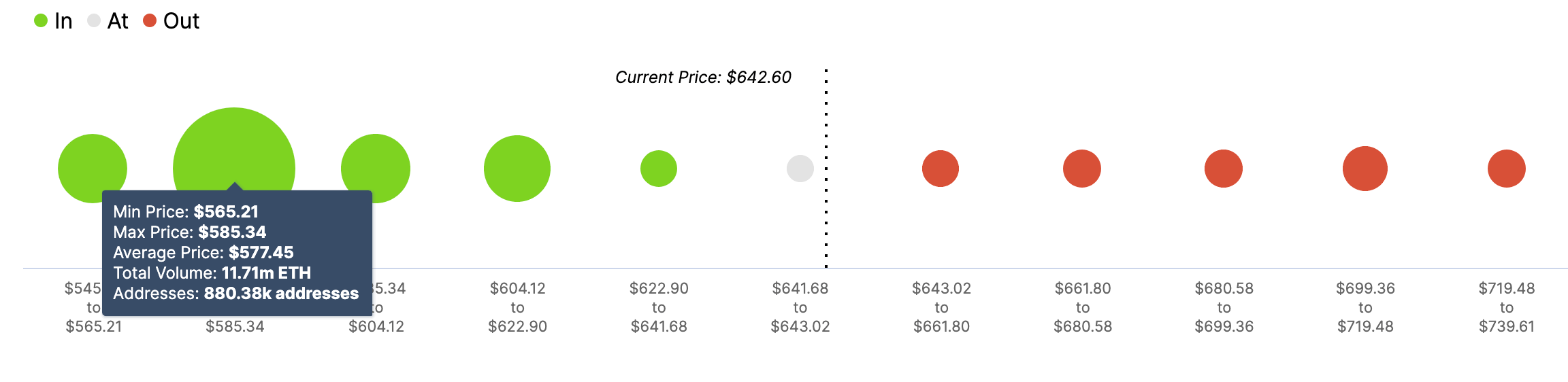

From the technical point of view, ETH is poised for further increase with the next aim at $780, 0.5 Fibo for the downside move from January 2018 high to December 2018 low. IntoTheBlock’s “In/Out of the Money Around Price” model shows that ETH bulls won’t face any significant resistance on the way to the above-mentioned resistance.

ETH In/Out of the Money Around Price

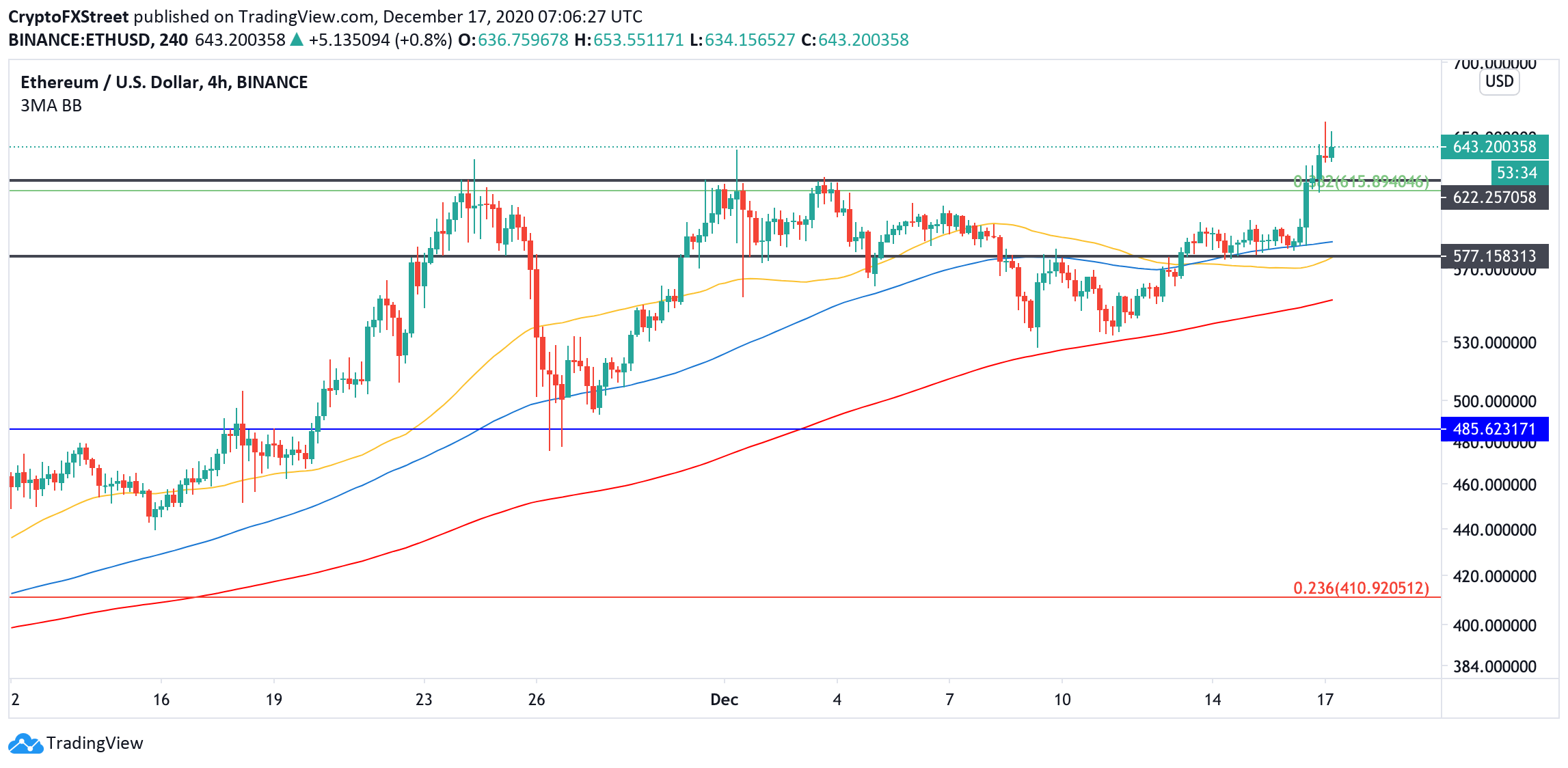

On the other hand, the significant support comes at $580 as 880,000 addresses purchased nearly 12 million coins around that level. This area served as previous channel support that limited ETH decline on numerous occasions in December. Now it is also reinforced by 4-hour EMA100 and EMA50. Once it is out of the way, the bearish correction may gain traction with the next target at $550 (4-hour EMA200) and psychological $500.

ETH, 4-hour chart

To sum it up, on the upside, the critical level to watch is $780 as a sustainable move higher will open up the way to $1,000 and the all-time high of $1,400. On the downside, the critical support comes at $580 as above below this area will invalidate the immediate bullish scenario.

%20Analytics%20and%20Charts-637437855389062353.png)