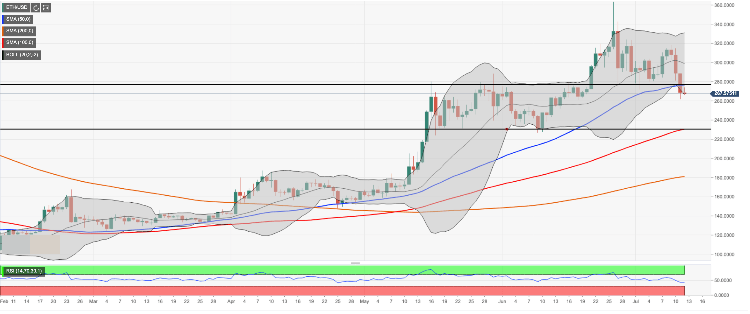

- ETH/USD bears push the price into the previous consolidation channel.

- The next support is created by a confluence of technical indicators at $230.

Ethereum, the second largest cryptocurrency with the current market capitalization of $28.9 billion, has been consolidating losses after a steep decline on Thursday. At the time of writing, ETH/USD is changing hands at $269.31, down nearly 5% in recent 24 hours and mostly unchanged since the beginning of Friday.

Ethereum’s technical picture

A sustainable move under $280 bodes ill for ETH bulls in the short run; the longer-term picture also looks worrisome as the price broke below SMA50 (Simple Moving Average) on a daily chart (currently at $276), coupled with the upper boundary of the previous consolidation channel. Unless the price returns above $276-$280 resistance area in the nearest future, the sell of will gain traction with the next bearish focus as low as $230. This support is created by the lower boundary of the said range and SMA100 daily.

On the upside, $300 is the area level to be cleared for a sustainable recovery. This psychological level is strengthened by the middle line of 1-day Bollinger Band, SMA100 4-hour and packed with short-term speculative orders. ETH bulls are likely to have a hard time making their way above this barrier. However, once this happens, the upside momentum will gain traction with the next focus on $329 (the upper edge of the 4-hour Bollinger Band) closely followed by $331 (the upper edge of the 1-day Bollinger Band).