- Ethereum platform is used by over 350 large corporations.

- ETH/USD bulls failed to settle above $170.00, but the downside correction may be limited.

Ethereum, the second-largest digital asset with the current market value of $18 billion, has been gaining ground after a short-lived retreat on Thursday. The coin has gained over 3% on a day-to-day basis and 2.8% since the beginning of Friday. ETH/USD attempted a rise above $174.00, but the move proved to be unsustainable and the coin slipped back below $170.00 level.

Ethereum is a platform of choice for many corporations

Adam Cochran, an editor of the Coffee and Coin news portal, found out over 350 projects that build their apps on Ethereum blockchain. Thus he defied speculations that Ethereum had no real use cases as no one actually built anything on its blockchain. He tweeted:

You may have heard a crazy claim that “no one really builds on Ethereum” and that “all the products being built on Ethereum are paid for by the Ethereum Foundation or ConSensys”

His examples include Nike, Barclays, TD Ameritrade, FedEx, Microsoft, Intel, Ubisoft, Amazon, American Express, Samsung, McDonalds and others.

ETH/USD: technical picture

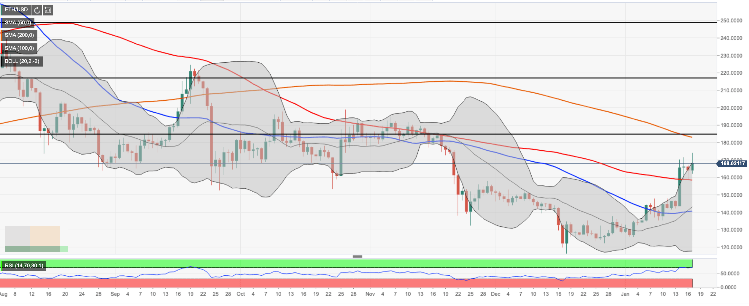

Ethereum has started a downside correction after an unsuccessful attempt to settle above $170.00 handle. In the short run, the downside momentum may he extended towards the initial support area created by SMA50 1-hour at $164.50. If it is cleared, the sell-off may be extended towards psychological $160.00 and a stronger barrier at $158.50 (SMA100 daily).

On the upside, the first target is $170.00. Once this barrier out of the way, the upside is likely to gain traction with the next focus on the intraday high of $174.22 and the longer-term bullish target of $180.00. SMA200 daily on approach to $183.00 is likely to slow down the bulls and trigger the downside correction before another bull’s wave towards 61.8% Fibo retracement at $164.70.

ETH/USD daily chart