- ETH/USD bulls managed to push the price above $200 handle.

- Strong support is created by $225 area.

Ethereum, the second-largest cryptocurrency with the current market capitalization of $22.3 billion, has recovered from the recent low of $197.50 and settled marginally above $200 handle. The coin has stayed mostly unchanged both on a day-on-day basis and since the beginning of Monday, moving in sync with the broader market.

Read also: Ethereum has earned public recognition on par with Bitcoin

Ethereum’s technical picture

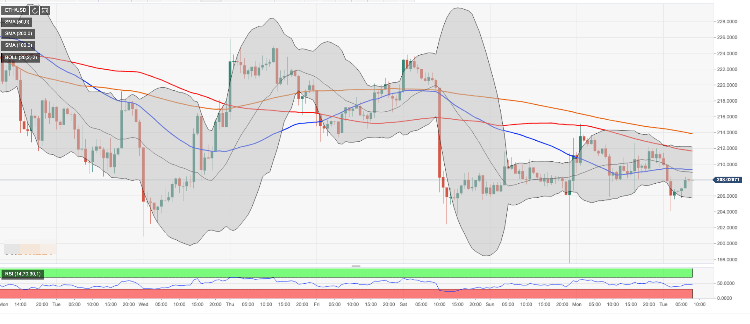

ETH/USD is locked in a tight range. The coin hit the intraday low at $204.09 and has been recovering slowly ever since.

On the intraday timeframe, ETH/USD is initially supported by $205.80. This barrier is created by the lower line of 1-hour Bollinger Band and followed by the ab0ve-mentioned intraday low on approach to $204.00. Once this support area is cleared, the sell-off is likely to gain traction with the next focus on psychological $200.00 and the recent low at $197.50.

On the upside, the local resistance comes at $209.00-$209.30 area. This resistance zone contains the middle line of 1-hour Bollinger Band and SMA50 (Simple Moving Average) on the same timeframe. The next barrier is located at $212 (SMA100 1-hour); however, the ultimate short-term resistance awaits us on approach to $225.00. A sustainable move above this handle will take us outside the recent range and allow for a more extended recovery.

Considering that the intraday Relative Strength Index (RSI) stays flat in the neutral territory, which implies range-bound trading.