- ETH/USD bears are celebrating victory as the coin trades below SMA100 daily.

- A recovery above $235 is needed to mitigate the immediate selling pressure.

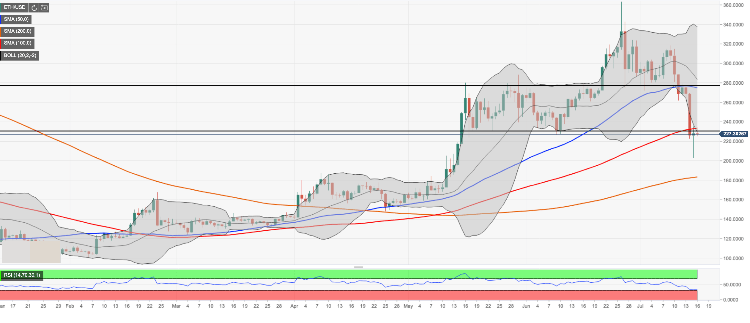

Ethereum, the second largest cryptocurrency with the current market capitalization of $24.4 billion, has recovered about 3% of its value in recent 24 hours to trade at $227.50 by the time of writing. ETH/USD has recovered from the recent low of $202.80, though the upside momentum is limited so far as the cryptocurrency market has entered a consolidation phase after wild gyrations of the weekend.

Ethereum’s technical picture

On the daily chart, ETH/USD touched $234.28 during early Asian hours; however, the bulls faced a stiff resistance created by SMA100 (Simple Moving Average) and the lower boundary of the previous consolidation channel located marginally above $230. We will need to see a sustainable move above $230-$235 area to mitigate the immediate bearish pressure.

Once it is cleared, the recovery is likely to gain traction with the next focus on $240.50 barrier strengthened by 38.2% Fibo retracement daily on approach. The next resistance comes at psychological $250.00 and $275.00 (SMA50 daily and the upper line of the above-said range).

On the downside, the nearest support comes at $22.60 (the lower line of 1-hour Bollinger Band), followed by $212.00 (the middle line of 1-week Bollinger Band). Once it is passed, the recent low of $202.80 and psychological $200.00 will come into focus.

This area is likely to create a recovery impulse; however, a sustainable move lower will bring $190 and $183.30 (SMA100 daily) into view.