- Ethereum price is flirting with 61.8% Fibo, while a support above $470 is critical.

- According to CoinMarketCap Ethereum trading volume fell from $2.2 billion to $1.9 in a couple of days.

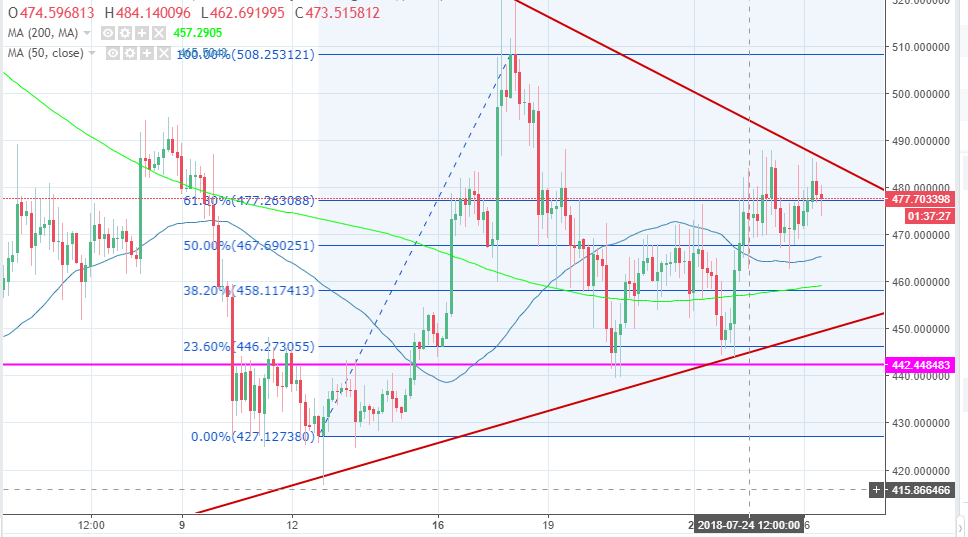

Ethereum price has lost momentum on trading slightly above $480 again. However, it is flirting with the 61.8% Fib retracement level with the last swing high of $508.25 and a swing low of $427.12 at $477. It is also trading a contracting triangle pattern on the 3-hour chart, which means that a breakout is in the pipeline.

Although Bitcoin, the largest cryptocurrency has is trading above $8,000 (long-term resistance), the same trend cannot be said about Ethereum which failed to maintain trading above $500. Ethereum lost momentum after testing the key level at $520; a move that had it slide lower testing the major support at $440. The Bitcoin bull rally this week tried to pullback Ethereum but as mentioned price movements keep losing momentum marginally above $480.

Further up, $490 is the immediate supply zone. Trading above this level will allow the buyers to curve path upwards towards $500. At the moment, a support above $470 will be good enough to give the buyers a chance for s sustained pullback above $480. The 50 SMA will work as a support at $465.37, but a stronger support is at $460.

Ethereum market capitalization has risen in the past couple of days from $45.5 billion to $48.4 billion at the close of the session on Wednesday. The trading volume has reduced in the same period from $2.2 billion to $1.9 billion. According to the data on CoinMarketCap, the trading volume in the last 24 hours is $1.6 billion. The decreasing trading volumes could also be the reason behind the falling prices and the lack of momentum to sustain a support above $480.

ETH/USD 43-hour chart