- ETH is bullish as long as it stays above SMA50 weekly.

- The first recovery target is set at $270.

Ethereum retraced from the recent high of $280.17 reached during the previous week and settled at $253.50 by the time of writing. The second largest digital asset with the current market value of $27 billion and an average daily trading volume of $11 billion has gained 1.4% since this time on Sunday, though it is still down 2.5% since the beginning of Monday.

Ethereum’s technical picture

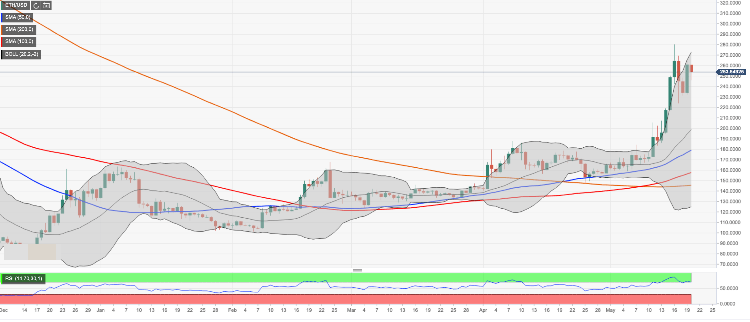

While ETH/USD has lost some ground, it is still above the upper boundary of weekly Bollinger Band ($227) and SMA50 weekly (currently at $221), which creates a positive technical environment and implies that the coin retains bullish potential in the long run. The weekly RSI (Relative Strength Index) also points upwards in confirmation of the bull’s case scenario.

A sustainable move below the said support area will open up the way towards psychological $200, strengthened by SMA100 (4-hour), followed by $180.00 with DMA50 located marginally above this level.

On the upside, the coin needs to regain $270 barrier (Sunday’s high and an upper boundary of the 1-day Bollinger Band) to resume the upside trend with the next aim at $280. Once it is cleared, the upside is likely to gain traction with the next focus on critical $300.

ETH/USD, thee daily chart